Crude oil price today as on 20th February, 2025

Crude Oil Flat Price Trends Today

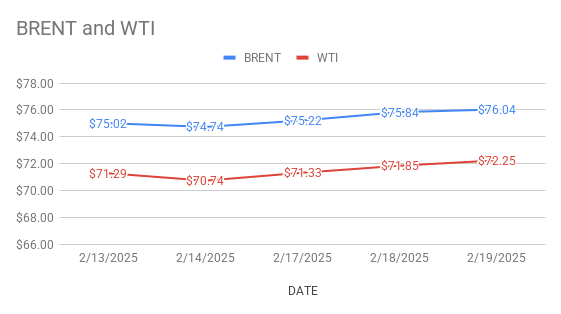

Crude oil Brent futures prices for April delivery up at $76.04 a barrel on Thursday morning hours. WTI Futures prices for March delivery trading at $72.07 a barrel on Today’s Asian hours session. Both the benchmarks flat futures closed up last night. Brent crude oil futures rose 20cents or 0.26 pct to $76.04 a barrel while WTI oil futures prices went up 40 cents a barrel or .56 pct to $72.25 a barrel last night. WTI March futures are set to expire today.

Brent WTI Spreads

Brent WTI spread is the difference in Brent crude oil spot price and WTI crude oil spot price. Brent spread over WTI narrowed down to $3.79 a barrel during the session.

Crude Oil Price Fundamental Analysis

Supply disruptions fears continued to prevail. Traders are weighing the affect of announced and actual sanctions. U.S brokered peace deal between Russian and Ukraine along with indirect negotiation between Israel and Hamas in the ME keep weigh on oil complex. Tariffs, Inflation fears, gloomy economic outlook, likely dent in demand outlook are the other bearish factors lingering around.

Crude Inventory Data Analysis

U.S weekly data is delayed due to holiday. Government Institutional numbers are due later today. consensus is on potential boost in U.S oil exports that will lent support to oil complex. Plenty of crude oil stock is piled up in U.S with expected heavy refinery maintenance season. let us see what weekly index shows today.

Crude Oil Technical Analysis

crude Index curves moving flat with little changes. Hedge funds and other money managers are moderately bullish with a net position in Brent futures and options equivalent to 289 Mb. Brent six month calendar spread has traded in an average backwardation of around $2.7, Only modestly tighter than average.

Srinivas Chowdary Sunkara comments on crude oil price movement

Weekly data might compound existing bearish mood. crude prices are expected to move sideways. U.S crude March futures set to expire. The Most active April futures prices may see some upside momentum on little buying pressure.