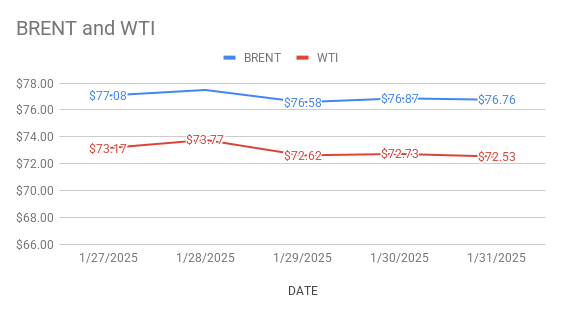

Crude oil price today as on 1st February, 2025

crude oil flat prices grinded lower this week. Brent oil March futures expired and settled down 11 cents at $76.76 a barrel while April contract futures prices rose 54 cents to $73.48 a barrel on London based ICE Futures Europe exchange. WTI oil futures for March delivery rose 73 cents or 1 pct to $73.48 a barrel on NYMEX last night. Both the benchmarks logged in above 2 pct loss for the second consecutive week.

Time spreads relatively resilient on flat price pull back over recent weeks. Strong performance of key timespreads despite of lower flat prices during the week indicates that much of the pull down in oil prices can be attributed to sentiment rather than deuteriation of economic performance. Report of first commercial crude build since mid-Nov weighed on U.S benchmark. Market positioning data reveals that while speculators were the net sellers of crude this week, their OI in these contracts rose to highest levels. Money managers widened their net length in brent while reducing WTI positioning to the week ending Jan 28th. U.S drillers added rigs during the week.

Turning to Fuel oil markets, VLSFO has pared on supplies catering to demand. HSFO markets are strong as crude markets spilled over tariff fears. Furnace oil price are very likely to increase in India.