Crude oil price today as on 19th February, 2025

Crude Oil Flat Price Trends Today

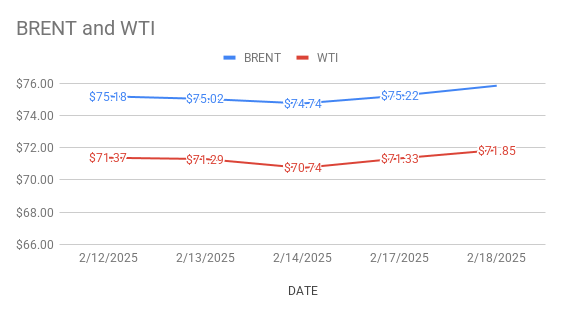

Crude oil Brent futures prices for April delivery up at $75.87 a barrel on Wednesday morning hours. WTI Futures prices for March delivery trading at $71.82 a barrel on Today’s Asian hours session. Both the benchmarks flat futures settled up last night. Brent crude oil futures rose 62 cents or 0.83 pct to $75.84 a barrel while WTI oil futures prices went up $1.11 a barrel or 1.57 pct to $71.85 a barrel last night.

Brent WTI Spreads

Brent WTI spread is the difference in Brent crude oil spot price and WTI crude oil spot price. Brent traded at a premium of $3.99 a barrel over WTI during the last session.

Crude Oil Price Fundamental Analysis

Supply disruptions news set a bullish tone for oil markets, limited by prospectus of ending Russia-Ukraine war. Day trade is controlling oil markets presently. Global tariffs, gloomy economic outlook and slowing demand patterns keep weigh on oil prices for last one month.

Crude Inventory Data Analysis

U.S weekly data is delayed due to holiday. Government Institutional numbers are due later today. consensus is on potential boost in U.S oil exports that will lent support to oil complex. Plenty of crude oil stock is piled up in U.S with expected heavy refinery maintenance season. let us see what weekly index shows today.

Crude Oil Technical Analysis

Brent index got support from speculators sharp buying move towards brent. Fund managers appears to have initiated another cycle of short selling against WTI in the last 3 weeks. Pessimism about WTI outlook relative to Brent likely stems from the trade war between U.S and China. The sharp divergence between Brent and WTI is the widest for more than eight years.

Srinivas Chowdary Sunkara comments on crude oil price movement

Bearish weekly data may spur some volatility on downside. day trade is seen this week.