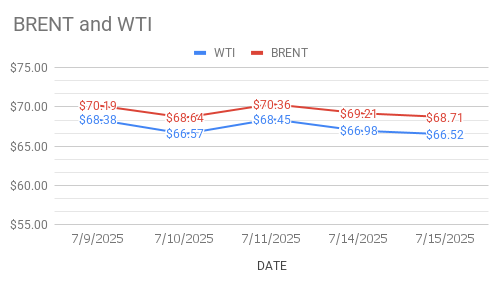

crude oil price Today as on 16th July, 2025

crude oil price trends: Brent oil futures for Sep delivery rose 31 cents or 0.45 pct to $69.02 a barrel on London based ICE Futures Europe exchange while WTI oil August futures prices went up 41 cents to $66.96 a barrel on NYMEX on Wednesday morning during Asian hours. Both the benchmarks settled down last night. Brent traded at a discount of $2.19 over WTI during the session.

Fundamental Analysis: Oil markets downplayed Tariff threats and shifted focus to ‘demand outlook’ from ‘supply disruptions’. Oil prices seasawed while walking on a tight rope. Turning to weekly numbers, API surprised markets with a prediction of massive build in crude stocks at 19.1Mbpd during the last week. Product stocks are expected to dip. EIA will confirm numbers later today. OPEC monthly report expectation of boost in oil demand in the second half of 2025 triggered some bullish sentiment in the market.

Brent Oil Technical Analysis: Brent RSI at 37.32, Approaching oversold zone that hint a reversal. Volumes are stronger than WTI, showing more interest. MACD curve is flattening, Hinting at possible momentum reversal. Brent is showing accumulation near bottom with buying pressure increasing near $69. Price may attempt rebound to $69.20 with resistance at $69.50 having suppot level at $68.40.

WTI OIL Technical Analysis: Volumes are light suggesting weak buying participation. RSI in Neutral zone with no overbought/ oversold condition. MACD shows a bullish crossover developing indeicates early signs of upside momentum. Slightly bullish. expected range between $66.50 – $67