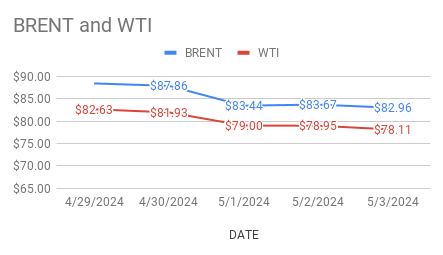

Crude oil price Brent futures for July delivery rose 70 cents or 0.844 pct to $83.66 a barrel on London based ICE futures Europe exchange. WTI crude oil June futures prices moved up 72 cents or 0.92 pct to $78.83 a barrel on CFTC at the time of reporting today. Both the benchmarks registered loss on Friday added to weekly losses last week. Brent premium over WTI narrowed down to $4.85 a barrel during the session.

Crude oil benchmark price index curves turned up today on bullish sentiment ignited by KSA price hikes to Asian customers. Both the world benchmarks logged in biggest weekly losses on Friday last week on weak financial markets data. On the fundamentals side, KSA hiking OSPs for its crude sold to Asia, Northwest Europe and the Mediterranean in June, Indicated strong demand. Fall in U.S oil rig numbers indicated supply tightening. Easing geo-political risk also compounded bearish sentiment in the market. Putting some light on technicals, Shorts covered positions last week while Longs remained hold positions in Brent oil. Portfolio managers reduced net length in some of the important petroleum futures and options last week. API numbers due tomorrow followed by EIA confirmations. Monthly numbers also due at the end of the week.