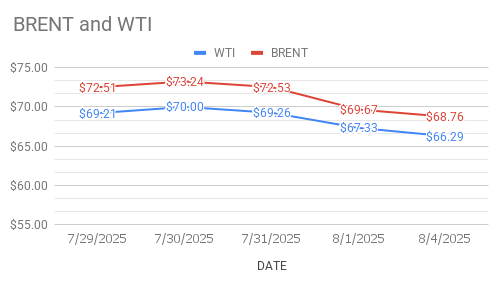

crude oil price Today as on 5th August 2025.

crude oil price trends: Brent oil Oct futures are trading at $68.77 a barrel while WTI oil futures for Sep delivery are moving at $66.29 a barrel with no change from last night close. Both the benchmarks closed above 1 pct down, at their lowest in a week, after declining close around 3 pct on Friday.

Fundamental Analysis: Supply side fundamentals are weighing on oil complex after OPEC+ agreed to another large output increase in September that compounded over supply fears and U.S data showed lacklustre fuel demand in the top consuming nation. The supplier’s council agreed to raise oil production by 547000 bpd for Sep during their meet on Sunday. The group cited strong market fundamentals to back its decision. Oil traders are hedging against the possibility of further supply increases. Markets continued to digest the impact of tariffs over Russian oil buyers. All eyes on Trump decision this Friday. Turning to numbers, Portfolio investors amassed more bullish positions in brent and distillates last week anticipating more restrictions over Russia oil that in turn expected to offset accelerated output increases by SA and other OPEC members. Weekly numbers due.

Brent Technical Analysis: Brent RSI and MACD confirming bearish pressure with strong technical score to sell. Bearish intraday but less intense than WTI likely rangebound but downward tilted.

WTI OIL Technical Analysis: RSI at 34 – 35 Indicating near oversold with potentially bottoming. ADX suggesting strong bearish trend while MACD is widening negative momentum. Volumes are consistent with heavy selling.

MCX Crude oil Technical Analysis: slight bearish to neutral. intraday trend flagged as downside. RSI around 30 and bearish MACD indicates downside momentum.