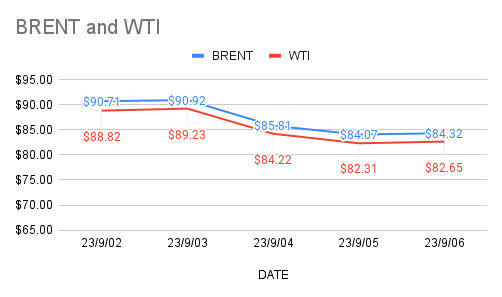

Brent Dec futures are trading at $84.21 a barrel while WTI oil Nov futures are trading at $82.47 a barrel on Friday during Asian hours with a little change on upper side. Both the benchmarks fell for the second session yesterday after a biggest tumble of 5 pct during Wednesday session. Brent traded at a premium of $1.76 over WTI during the yesterday’s session. Fundamentally speaking, crude drop off is a spill over from sell off from financial markets. High interest rate fears, Dip in U.S government spending and dent in U.S gasoline demand compounded the prevailing bearish sentiment. On the flip side, It is speculator game and the investors are leaving the crude markets to book profits after a surge to 2023 high last week. Crude markets are clung to biggest weekly loss. The non-farm pay-roll data , U.S CPI and China’s economic data are the factors that may spur some volatility next week. U.S rig numbers data is due later today.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com