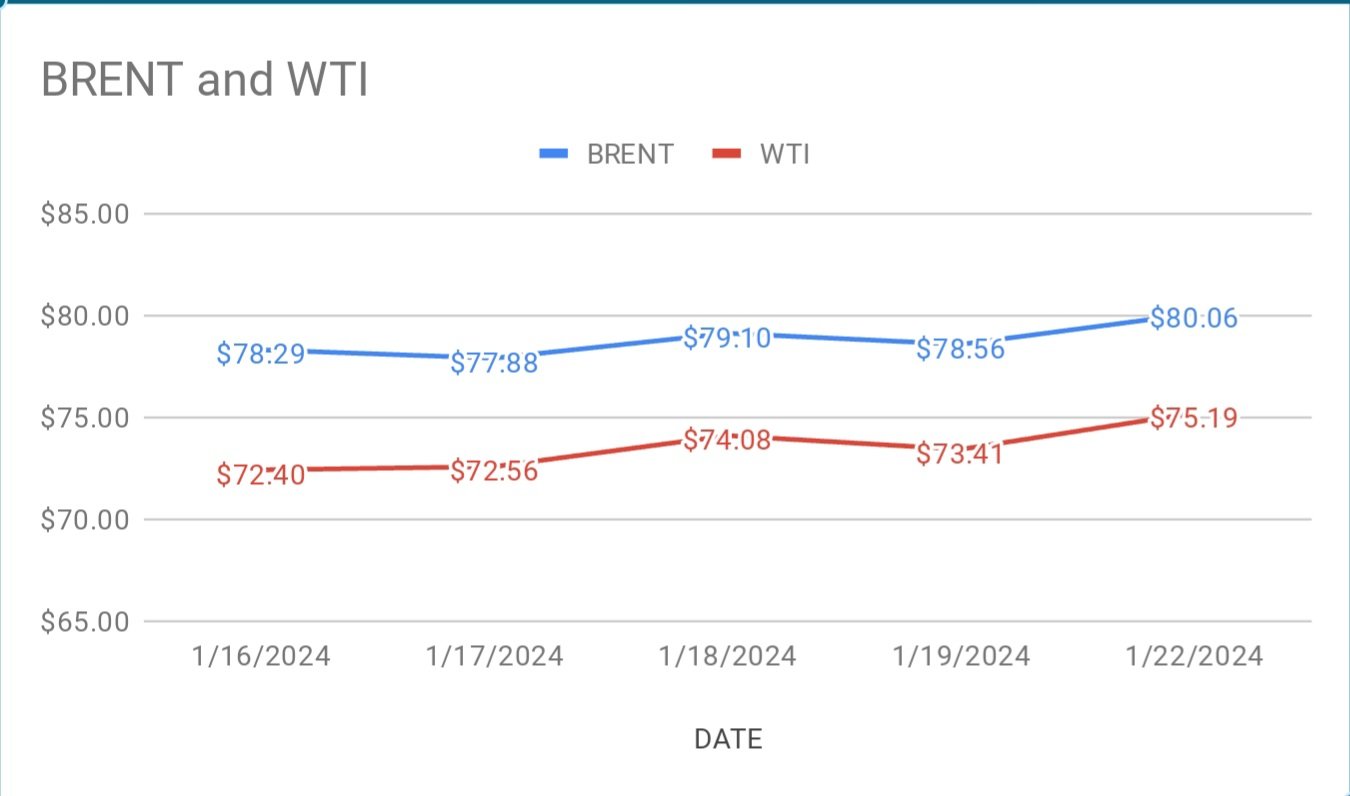

crude brent, march Futures moving steadily at $79.97 a barrel while wti Futures for March delivery added $1.22 to $74.63 a barrel on Tuesday morning during asian hours at the time of reporting. Both the benchmarks traded up 2 per cent yesterday. Brent premium narrowed down to $4.87 over wti during the session.

crude benchmark curves demonstrated upside momentum on Monday on strong supply fundamentals. Both the benchmarks March Futures traded up yesterday. Wti Feb contract expired. Genuine supply concerns lent support to oil complex. U.S crude production hampered due to severe cold weather and ukraine drone attack on novatak are the bullish factors seen that out weighed economic concerns in the market. On technicals side, portfolio managers preferred to increase net length in brent more than that of wti during the week ending 16th jan.. Investors are building longs, anticipating range bound in crude markets in the short term.

crude traders want to be bullish but cautious write ups from analysts on economic activity keeping them on back foot. API numbers are due followed by eia confirmation. U.S economic numbers are awaited. Crude markets are expected to be in range bound this week.