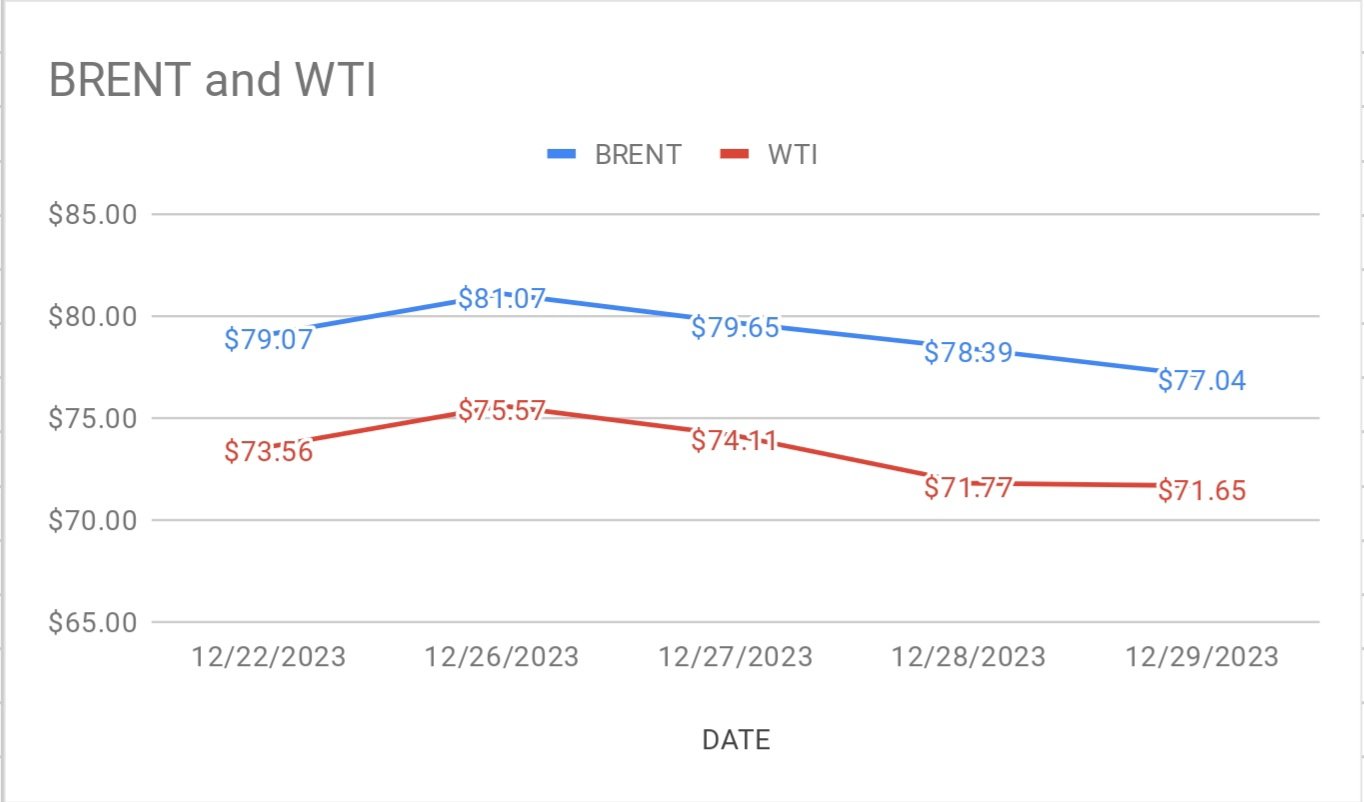

crude brent march futures prices jumped $1.43 or 1.856% to $78.47 a barrel while WTI futures for Feb delivery trading $1.19 or 1.661% up to $72.84 a barrel on Tuesday morning during Asian hours at the time of reporting. Both the benchmarks are buoyed up by strong bullish sentiment amid escalation of naval clash in the red sea.

crude world benchmark price index curves demonstrated upside momentum in the first session of new year. Potential supply disruptions in red sea waters, Strong demand outlook in holiday season and expected economic stimulus in China are the prevailing bullish factors that lent support to oil complex. Analysts forecast brent crude would average $82.56 a barrel in the new year as compared to that of $82.17 a barrel in 2023. Geo-political tensions and economic outlook are the key factors that direct the crude price curves in this year.

On the technicals side, Money managers surged their positions in major petroleum futures and options till the week ended Dec 26th, 2023. Long only positions widened along with shorts in both the benchmarks futures at ICE and CFTC as reported. Weekly numbers followed by rig numbers are awaited this week. I strongly see bullish momentum this week.