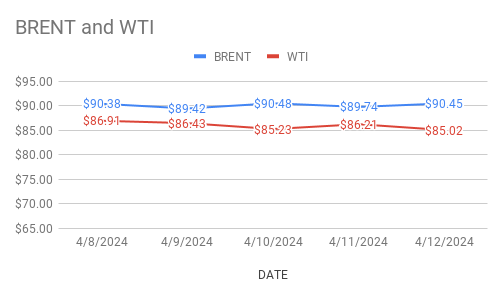

crude Brent oil June futures prices rose 71 cents to $90.45 a barrel while WTI May futures prices went up 64 cents to $85.66 a barrel on Friday. Both the benchmarks registered weekly losses. WTI discount over Brent widened to $5.43 a barrel during the session.

crude benchmark index curves slanted down amid bearish sentiment ignited by gloomy demand growth reported by IEA MOR. Though crude markets are well supported by the ongoing political turmoil between Iran and Israel, bearish Monthly numbers capped the rally. Turning to monthly oil report, The International Monetary Agency reported cut its forecast for 2024 world oil demand growth to 1.2 Mbpd while OPEC said that world oil demand will growth by 2.25Mbpd in 2024. As per analysts, Markets are in a mood to focus on OPEC estimate of 2.2Mbpd demand numbers in 2024 as opposed to IEA prediction. Turning to supply side factors, Traders are more focused on Iran warning of retaliation attack on Israel. Supply threats are seen in the market as Tehran may shut Suez Canal as part of retaliation action. Putting some torch on technicals, Portfolio managers raised their net long futures and options positions both the benchmark futures as reported by ICE and CFTC. U.S oil and gas rig count fell by 3 to 617 om the week to April 12, the lowest since November.