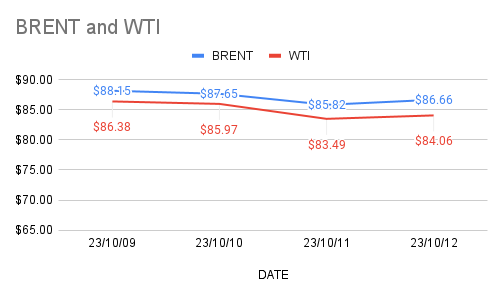

Brent oil futures for Dec delivery edged up 97 cents or 1.13 % to $86.79 a barrel while WTI oil Nov futures rose 80 cents or 0.958% to $84.29 a barrel today at the time of reporting. Both the benchmarks clocked around 2 % losses yesterday. Brent premium over WTI widened to $2.33 during the session.

The world crude benchmarks futures traded down yesterday on swelling U.S crude and product stocks during the last week, trouncing the analysts expectation as reported by API. U.S crude stocks reportedly expected to build by 12.94 Mbpd while gasoline stocks are piled up by 3.645Mbpd where distillates are expected to draw down by 3.545Mbpd. EIA will confirm numbers later today. Consensus is on draws. Bearish weekly numbers that signaled anemic demand outlook weighed on oil complex.

It seems Middle east conflict factor getting faded as the conflict is limited to Israel and Hamas. The risk factor associated with the war continues to erode as the markets are shifting focus to number indicators. Monthly numbers are awaited this week.