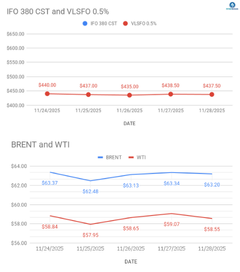

Crude Futures Flat prices rose around 1 pct to finish the week a hair above $63/bbl this week. Both the benchmarks logged in above 2 pct monthly loss. Cease fire reports in the early week precipitated price rout on Tuesday, Though contracts spent the remaining week, clawing back early losses to end the week in gains. Timespreads largely unchanged during the week. Inventory data painted bearish picture with a large build in U.S inventories. Market positioning data showed that speculators are the net sellers in Brent F&O, bringing Brent specific positioning back into over sold territory.

Fuel oil markets traded in bearish mood during the week. HSFO discounts deepened while VLSFO markets were back into discounts in Asia at Singapore trading window. Prompt markets remained well supplied, leading to emerging trade offers VLSFO markets traded in tight. FO LDO prices set to change in India for the first half of Dec, 25. Consensus is on down side revision.