Crude Flat prices slipped with Brent closed the weekly above $2 down. AI driven worries clouded tensions across the market. Oil specific fundamentals like over supply fears continued to prevail in the market. U.S proposed peace deal between Russia and Ukraine in headlines that removed last bullish support levels. Timespreads strengthened with brent prompt spreads rising. Weekly inventory numbers mixed with U.S stocks on the low levels. Market positioning data showed that speculators are the net buyers of Brent futures last week. CFTC data will be released from Jan, 26.

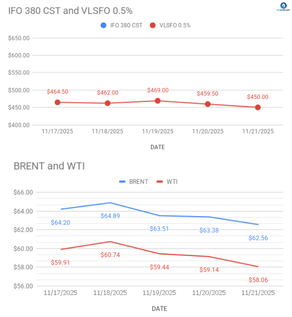

Asia Fuel oil markets demonstrated downside momentum at Singapore trading window during the week. HSFO spot discounts narrowed down with trades emerged at rangebound level in early to mid Dec. VLSFO broadly unchanged with cash differentials stuck in small premium. FO prices reduced while LDO prices revised up in India for the second half of Nov, 25.