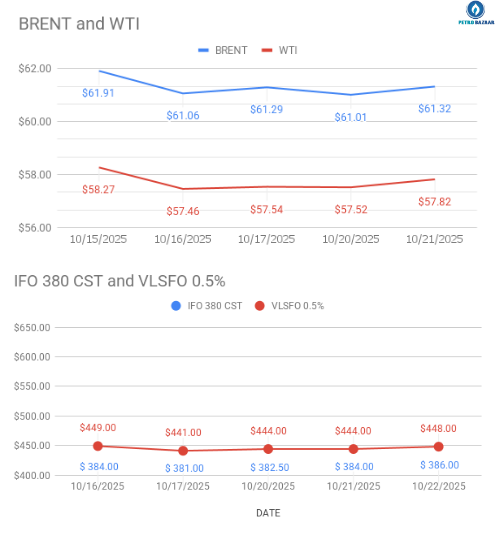

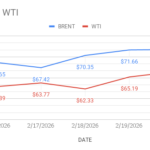

Crude oil futures prices are rising for the second consecutive day. Both the benchmarks for Dec delivery buoyed up by prospectus of India-U.S trade deal that could see India gradually reduce Russian crude imports. Trump statement over meeting with Chinese counterpart created uncertainity. He said on Monday that he is looking forward to work with Chinese president to arrive at fair trade deal. Investors are watching carefully. Geo-politics are in headlines. Bullish Weekly numbers also lent support to oil complex. Both the crude and product stocks fell down last week in U.S as per reports.

Fuel oil markets fell into a wider contango structure. The Fuel oil market strcture softened on Tuesday at Singapore trading window. The intermonth spreads for both HSFO and VLSFO slipped into wider contango due to over supply and weaker demand across the markets. Chinese fuel oil imports and bunker exports surged in Sep as per reports. FO LDO prices are expected to go down for the first half of Nov, 2025.

FAQ: what are Intermonth spreads in Fuel oil markets?

Intermonth spreads also called as time spreads or calender spreads. It refers to the price difference between futures contracts of the same commodity but different delviery months. Intermonth spread = Price of Near Month Contract – Price of the Far month contract. EG: If Fuel oil Oct contract futures price is $520/ton while Nov future price is $530/ton, Then the Oct-Nov spread is 520 – 530 = $10. This means the market is in contango (near month is cheaper).