By Srinivas Chowdary Sunkara // petrobazaar // 20th August, 2019.

The Bunker Price Index consist of a range of prices for 180 HSFO, 380 HSFO and MGO (Gasoil) in the main world hubs demonstrated upward trend yesterday. On the other hand, the global HSFO prices have plummeted to near two-years lows this month as the market started feeling pressure from the upcoming IMO2020 rule. The average IFO 380 prices across the four major global bunkering ports of Singapore, Fujairah, Rotterdam and Houston has fallen 21% over the last two weeks. The price trend indicates that the vast majority of the vessels will begin to transition away from HSFO during Q4 of this year.

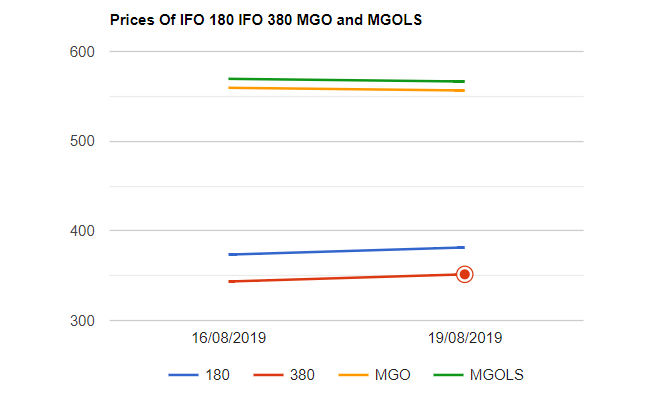

In Singapore, Both the Fuel oil 180 cSt and 380 cSt grade prices moved $8 up to $381.5 and $351.5 while MGO and MGO(LS) futures prices edged down by $3 during the yesterday's session. The global crude benchmark price index surged around 2% as the market tried to price in the geopolitical tensions premium after the week end drone attack on KSA. Softening of trade war tensions and equity rally also supported crude index.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com