By Srinivas Chowdary Sunkara // petrobazaar // 19th October 2021.

BUNKERING NEWS

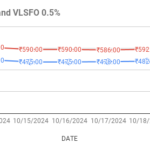

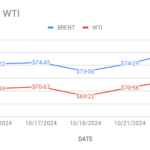

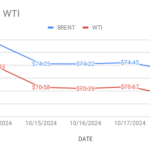

The Bunker Price Index consist of a range of prices for 380 HSFO , MDO and MGO(Gasoil) in the main world hubs traded flat across the major ports during the week. In Singapore, HSFO 380 cSt prices stood at $525 while MDO prices remained at $603.25 where as MGO prices closed at $728.75 during the week.

FUEL OIL PRICE TRENDS

In Singapore bunker markets, VLSFO supplies tightened with a lead time up from eight to 10-11 days. HSFO became less available with a lead time stretching to 12 days while LSMGO is more readily available with five to seven days ahead. Singapore bunker market has tightened due to delayed barge loading schedules after a worker tested positive for covid19. Bunker market is still congested after Tropical Storm Shaheen lashed the area with strong winds last week. Supplies of all three fuel grades continues to be difficult with HSFO being particularly tight in the port with lead times at 8 days ahead. VLSFO and LSMGO slightly more readily available with six days ahead. LSMGO recently dried up in UAE bunkering hub as with only a few suppliers having available product. Bunkering operations resumed in Xue Shan and Ningbo on Tuesday after being suspended for two days due to typhoon line rock congestions has built up in Xue Shan, with most suppliers able to accommodate stems from the 19th of Oct onwards. At the same time, Hongkong was hit by typhoon . Some bunker supplies stopped offering on Wednesday due to the weather conditions while other were offering subject to weather conditions.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com