By Srinivas Chowdary Sunkara // petrobazaar // 25th Dec 2019.

Brent oil futures prices rose 81 cents to $67.2 and WTI oil futures prices gained 59 cents to $61.11 a barrel last night. In Shanghai, Crude oil main contract futures prices closed 2 Yuan or 0.42% up at 480.4 Yuan/barrel whereas the MCX crude futures closed Rs.31 up at Rs.4356 yesterday. Brent premium to WTI widened to $6.09 during the session.

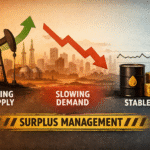

The world crude benchmark indexes moved up around 1% in thin pre-Christmas trading after Russia's statement to cooperate with OPEC group to rein in supplies, Fueled the optimism over the U.S and China coming closer to sign the first phase of trade agreement. On the supply side, A deal was signed by Kuwait and Saudi on the Neutral Zone between the two countries which could add to supplies next year. Guyana became an oil producing nation on the 20th Dec 2019 as the commercial oil production has started from the Liza field. Americans are trying to fill the gap created by producer's group by pumping ever greater amount of crude to reach a record high of about 13 million bpd in Nov.

Analysts are in the opinion that OPEC+ further cuts in the first quarter of 2020 may not solve the problem and they need to do something more than what they are doing currently as the market is going to face the headwinds of supply gluts in the new year. As per Reuter's survey, U.S crude stocks are drawn during the last week. Weekly stock reports are delayed by two days due to Christmas festival. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com