By Srinivas Chowdary Sunkara // petrobazaar // 20th Sep, 2019.

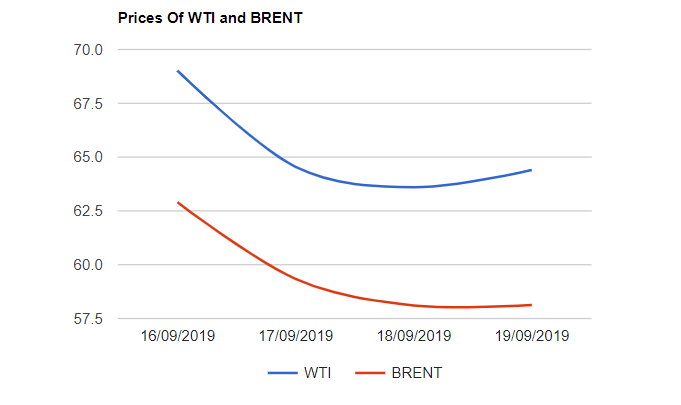

Brent oil prices for Oct delivery edged up 80 cents to $64.4 and US crude futures to be delivered in Nov pared earlier gains, closed flat at $58.13 a barrel last night. In Shanghai, Crude oil main contract futures dropped by 15.2 Yuan or 3.21% at 458.4 Yuan/barrel while MCX crude futures settled Rs.26 up at Rs.4176 yesterday.

The world crude oil price index moved largely on fears of larger than expected supply shortfalls following the last week end's attacks on Saudi's facilities. The questions that are hanging over the market's head is how US and Saudi will respond to these attacks? and KSA manages to restore the lost production by the month end?. In Saudi, Abqaiq facility restarted and processing about 2Mbpd, restored under half the output lost during the attacks. Tensions are prevailed in the region amid expected further threats on oil facilities.

Today morning, Asian markets are opened with gap up, extending yesterday's gains. The oil index does not demonstrate any firm trend so far. I expect markets will prefer to be firm to day. Rig number are awaited later today. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com