International Energy Agency’s January 2024 Oil Market Report signalled a clear shift from a tight post COVID oil market to a more supply heavy and balanced phase a view that still aligns closely with current market conditions.

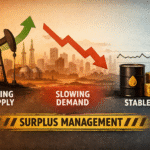

Supply : The IEA highlighted strong non-OPEC supply growth, led by the US and other Americas, pushing global output to record levels. This supply expansion laid the foundation for persistent surplus concerns seen in today’s market.

Demand: Demand growth was expected to slow sharply in 2024 after a strong 2023, mainly due to softer Chinese growth and economic headwinds. Current demand trends remain steady but not strong enough to absorb rising supply.

Prices: With supply outpacing demand, the report implied limited upside for crude prices. This remains true today, with prices reacting to geopolitics but capped by ample inventories.

Market Sentiment: The tone shifted to caution, moving away from scarcity fears toward surplus management—a sentiment that continues to dominate oil markets now.