Wounded Khazakh supply to an unexpected winter storm to renewed Iran risks

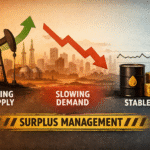

Crude flat prices inched up below $1, logged the week in gains. Benchmarks opened this week in a possitive terrotory, stretched to 7 week high on Wednesday over ‘Iran Risk’ factor. An abrupt about-face from the White House prompted a rapid unwinding of the risk bid. Venezuela barrels re-entry into local market weighed on WTI specifically. Inventories data painted bearish sentiment this week over large and counterseasonal builds for US and ARA Europe as well as bunker fuels in Singapore markets. On the technicals side, Market positioning data over the past week through Tuesday showed the speculators of the net buyers of crude contracts that pushed oil prices to highs on Wednesday. Shorts building also remain high during the week.

Fuel oil markets strengthened during the week in Asia at SG trading window. VLSFO premiums went up over Brent momentum while HSFO discounts narrowed. Supply glut continue to prevail in Singapore markets while Venezuela oil reshuffling to the US Gulf Coast tightend Asia markets . HSFO sold off for some derivative contracts last week also supported markets. Furnace oil (FO) retail selling prices went up while Light Diesel Oil (LDO) prices revised down in India by OMCs for the second half of Jan, 2026.