The U.S. Energy Information Administration (EIA) has released its Weekly Petroleum Status Report for the week ending August 8, 2025, highlighting key movements in crude oil balances, product demand, and price trends.

Key Insights

- Refinery Throughput Steady : Crude oil refinery inputs averaged 17.18 million barrels per day (bpd), with utilization at 96.4%, reflecting sustained high operational levels. Gasoline output stood at 9.8 million bpd, while distillate production reached 5.1 million bpd.

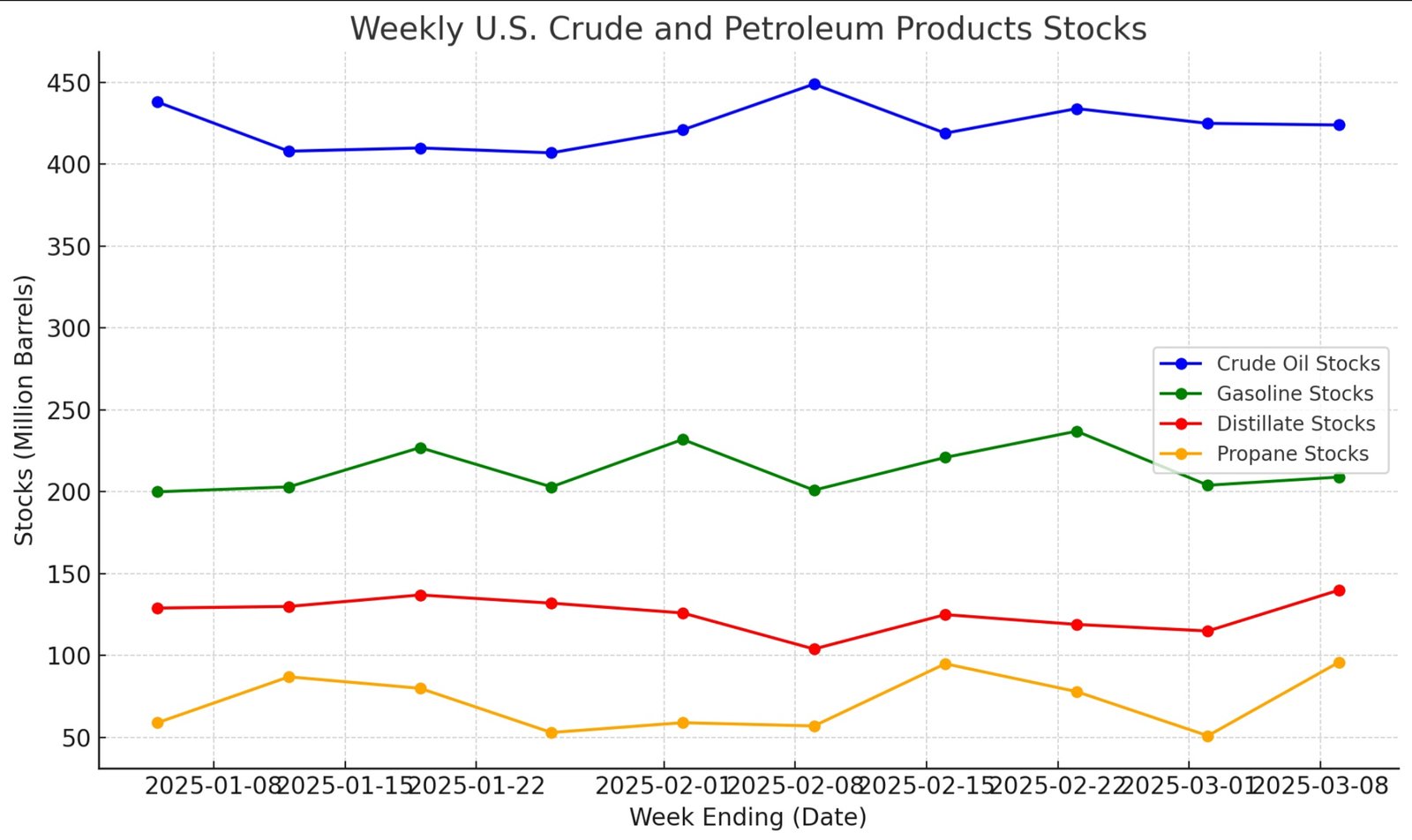

- Crude Imports & Inventory Build : U.S. crude oil imports surged to 6.92 million bpd, contributing to a 3 million barrel build in commercial crude stocks. Total crude inventories reached 426.7 million barrels, still about 6% below the five-year average.Product Inventories MixedDistillate stocks tightened further at 113.7 million barrels, nearly 15% below seasonal norms, while propane/propylene inventories rose to 88.6 million barrels, around 11% above the five-year average.

- Demand Trends: Total products supplied averaged 21.2 million bpd over the past four weeks, up 2.9% year-on-year. Gasoline demand eased to 9 million bpd (–1.5% YoY), while jet fuel consumption grew by 4.3%, signaling stronger aviation activity.

- Price Movements: WTI crude averaged $64.94/barrel, down from last week and significantly lower than a year ago.Retail gasoline averaged $3.118/gal, while diesel stood at $3.754/gal, both recording modest weekly declines.

- Market Outlook: The petroleum balance reflects a stable supply environment supported by higher crude imports and refinery runs. However, tight distillate inventories remain a concern for the downstream market, even as gasoline and diesel prices soften. Robust jet fuel demand points to continued momentum in the aviation sector.