OPEC Lifts 2026 Oil Demand Outlook, Market Remains Tight – August 12, 2025 – Hyderabad

OPEC’s August 2025 Monthly Oil Market Report projects stronger global oil demand next year, revising its 2026 growth forecast upward to around 1.38 million barrels per day (mbpd). The increase reflects resilient economic activity and steady consumption patterns across key markets.

Non‐OPEC+ supply growth for 2026 has been trimmed to roughly 0.63 mbpd, as output projections from some major producers have been lowered. Meanwhile, OPEC+ will raise production quotas by 547,000 barrels per day starting in September, marking the highest quota level in two years.

Despite these planned increases, actual supply growth may remain limited due to capacity constraints in some member countries. Strong demand and continued stockpiling are keeping the physical oil market tight.

With stable economic conditions expected through the second half of 2025, OPEC’s outlook remains cautiously bullish — suggesting ongoing support for prices in the months ahead.

Market Impact for Petrobazaar Readers:

Indian Crude Basket – May see a ₹150–₹250/barrel uplift in August–September, depending on forex and freight costs.

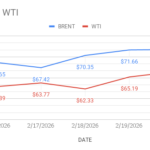

Brent Crude – Likely to stay supported above key $78–$80 levels in the near term, with upside potential if supply constraints persist.

WTI Crude – Could remain firm in the $74–$76 range, tracking Brent’s strength but capped by higher US output.

source:OPEC MOMR