Crude oil price today as on 13th March, 2025

Crude Oil Flat Price Trends Today

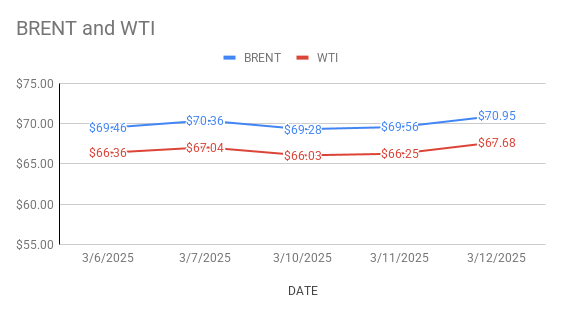

Crude oil Brent futures prices for May delivery dipped to $70.86 a barrel on Wednesday morning hours. WTI Futures prices for April delivery trading down at $67.51 a barrel during Asian hours today at the time of reporting. Both the benchmarks flat futures settled 2 pct up last night.

Brent WTI Spreads

Brent WTI spread is the difference in Brent crude oil spot price and WTI crude oil spot price. Brent spread over WTI remains flat at $3.27 a barrel during the session.

Crude Oil Price Fundamental Analysis

Positive weekly U.S stock numbers triggered around 2 pct rally during yesterday’s session. Progressing bullish and bearish factors simultaneously, Markets found difficult to lean on either side. Trump focus on tariffs, broader economic concerns and expected ample supplies from OPEC group are the fundamental trade irritants prevailed in the market.

Crude Inventory Data Analysis

EIA report revealed that U.S gasoline stocks fell by 5.7 Mb, trouncing back analysts expected 1.9 Mb draw. Crude stocks jumped while distillated stocks accumulated last week as per report. Decreasing gasoline stocks signaled seasonal demand amid demand fears across.

Crude Oil Technical Analysis

We saw selling in Brent across the board in the very recent week while WTI witnessed a significant buying. There was significant buying over NYMEX and ICE, All of which was attributable to repurchasing previous short positions. Traders started selling WTI much harder than Brent since January, that created the largest gap between WTI and Brent positions for eight years.

Srinivas Chowdary Sunkara comments on crude oil price movement

We see many range bound trades in crude markets due to strong fundamentals. Markets are expected to be flat broadly.