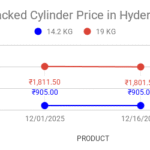

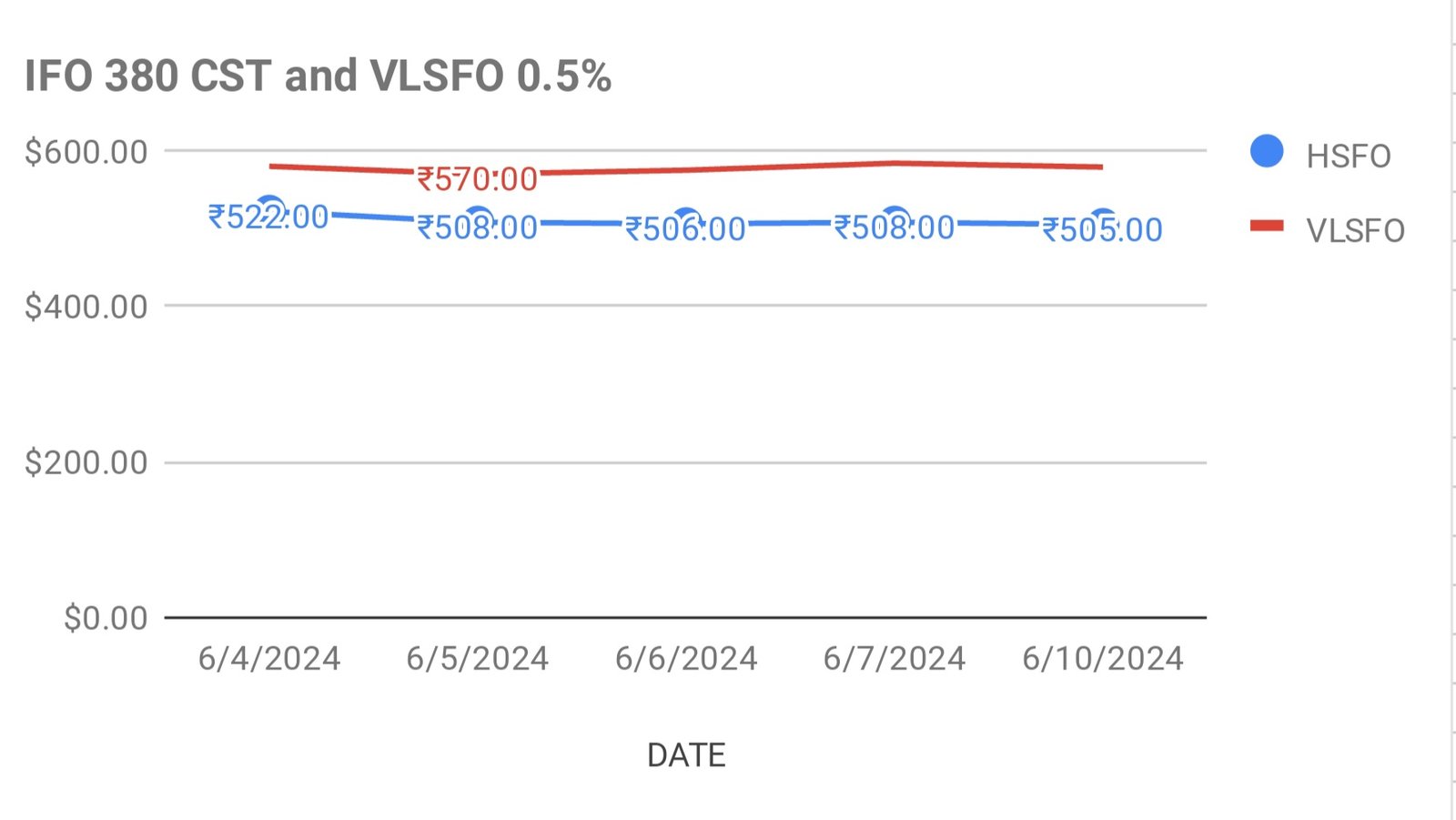

Fuel oil prices in Asia remain strong. HSFO spot premiums and refining margins remain strong due to lower supplies from middle east markets, weighing on shippers and refineries fuel budgets. Adherence to OPEC + production cuts also fueling the prices up since supply cuts restrain heavy sour crude from key suppliers like KSA and UAE, curbing fuel oil production. Drop in exports from middle east will widen the backwardation market structure for fuel oil since prompt prices are higher than futures prices due to limited supplies. Russian barrels and Middle east fuel oil is not moving towards Asian markets to Utilise for their own power generation. Turning to other markets, crude oil markets remain in sideways, searching for new clues. Furnace oil and LDO prices are set to change for every fortnight in India. FO prices may change either ways

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com