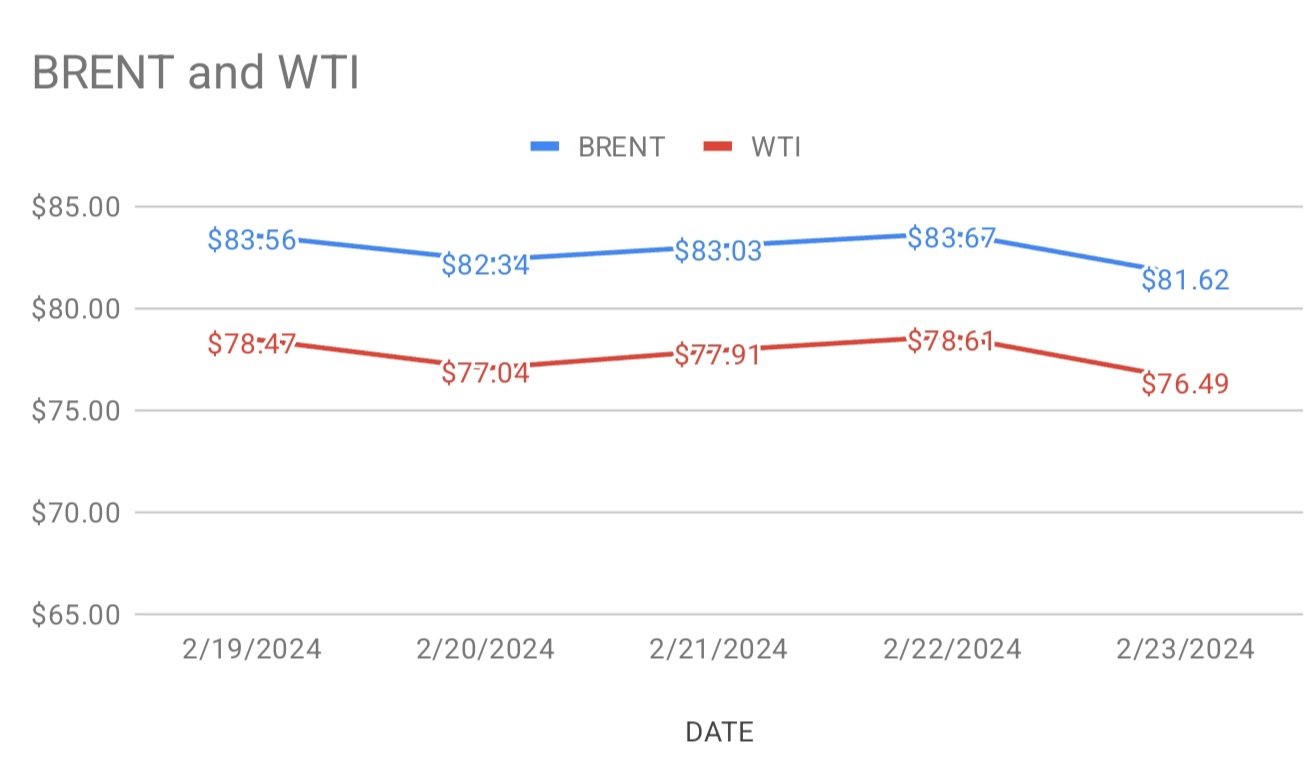

crude brent oil Futures prices for April delivery edged above 1 percent down at $80.61 a barrel while wti oil April futures are trading at $76.28 a barrel on Monday morning. Crude benchmarks ended lower last week after falling around 3 percent on Friday. Brent traded at a premium of $5.13 over wti during Friday’s session.

Crude indicators tilted towards downside in a bearish sentiment buoyed up by demand worries across last week. Delay in cutting U.S Fed interest rate sprinkled oil demand worries in the market last week. U.S drillers added oil rigs as per baker Hughes report, compounded existing bearish sentiment. Although geo-political factors keep supporting oil prices, Gaza cease fire talks underway in Paris. Turning to technicals, Investors booked profits last week. Portfolio managers increased their positions to oil Futures and options during the week ending Feb 20th. As per CFTC and ICE data released on Friday, Brent net length widened by 3760 lots and wti net length increased by 18493 positions. Longs seems to be leaving the market while shorts remain dominating the oil market. Crude markets are trying to figure out direction. Weekly numbers are awaited during the week. Expected healthy fuels demand keep markets strong.