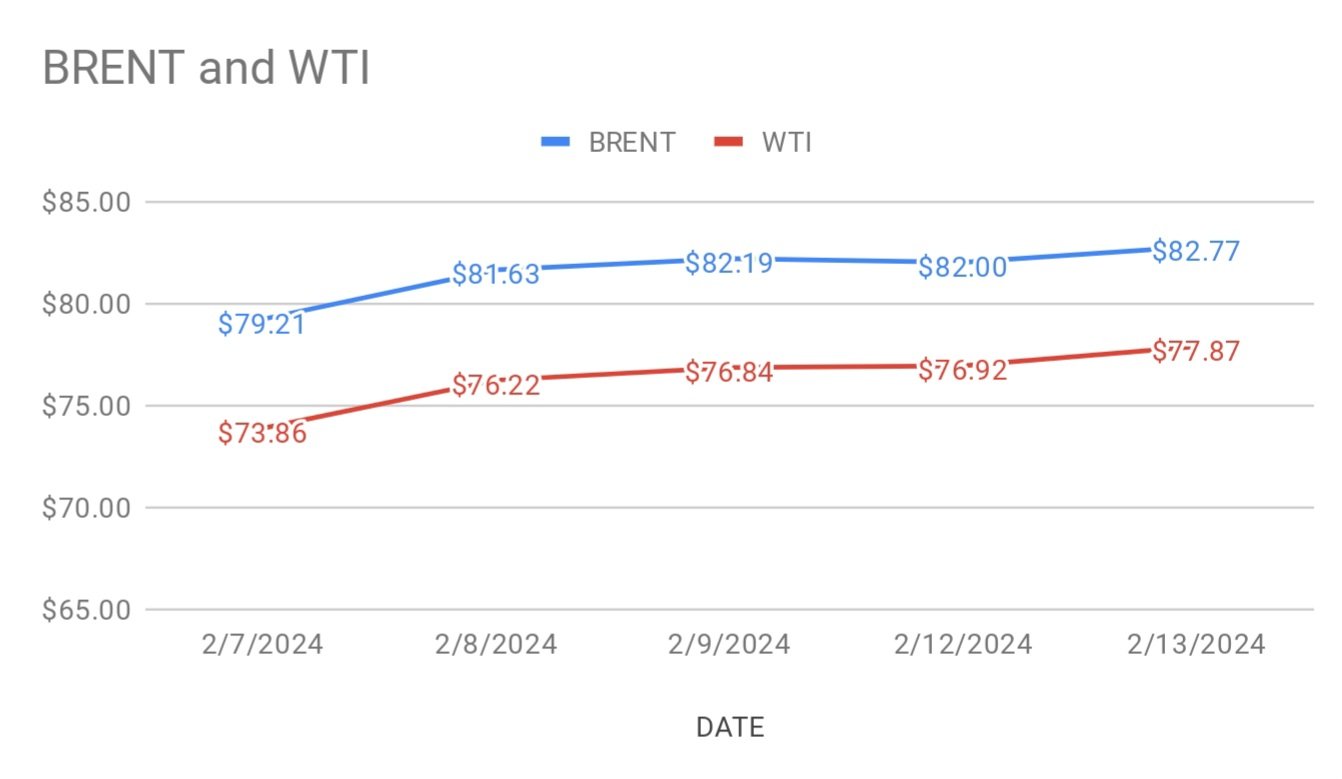

crude brent oil April futures prices changed a little at $82.69 a barrel while wti oil march futures are trading at $77.86 a barrel on Wednesday morning during Asian hours. Both the benchmarks closed around 1 percent up yesterday. Brent premium over wti narrowed down to $4.9 a barrel during the session.

crude benchmark curves titled towards bearish zone on more than expected crude stocks. Sticky inflation also spilled over demand fears across the market . Supply concerns kept floor to oil complex. U.S consumer inflation stayed elevated last month that fanned economic and demand worries. Strong dollar also weighed on oil prices. Turning to weekly data, API reported expectation of crude build of 8.52 Mbpd Trouncing analysts expected rise of 2.6 Mbpd last week. Gasoline and distillates stocks are expected to draw by 7.23 mbpd and 4.02mbpd respectively. Eia will confirm numbers later today. Consensus is on build. Putting some light on monthly report, OPEC reported demand growth of 0.04 Mbpd in 2023, 2.25 Mbpd in 2024 and 1.85 Mbpd in 2025. Demand growth numbers remained unchanged for years 23 and 24. The producers group raised some concerns on Adherence to its recent production cut plan. EIA and iea numbers may spur some volatility this week.