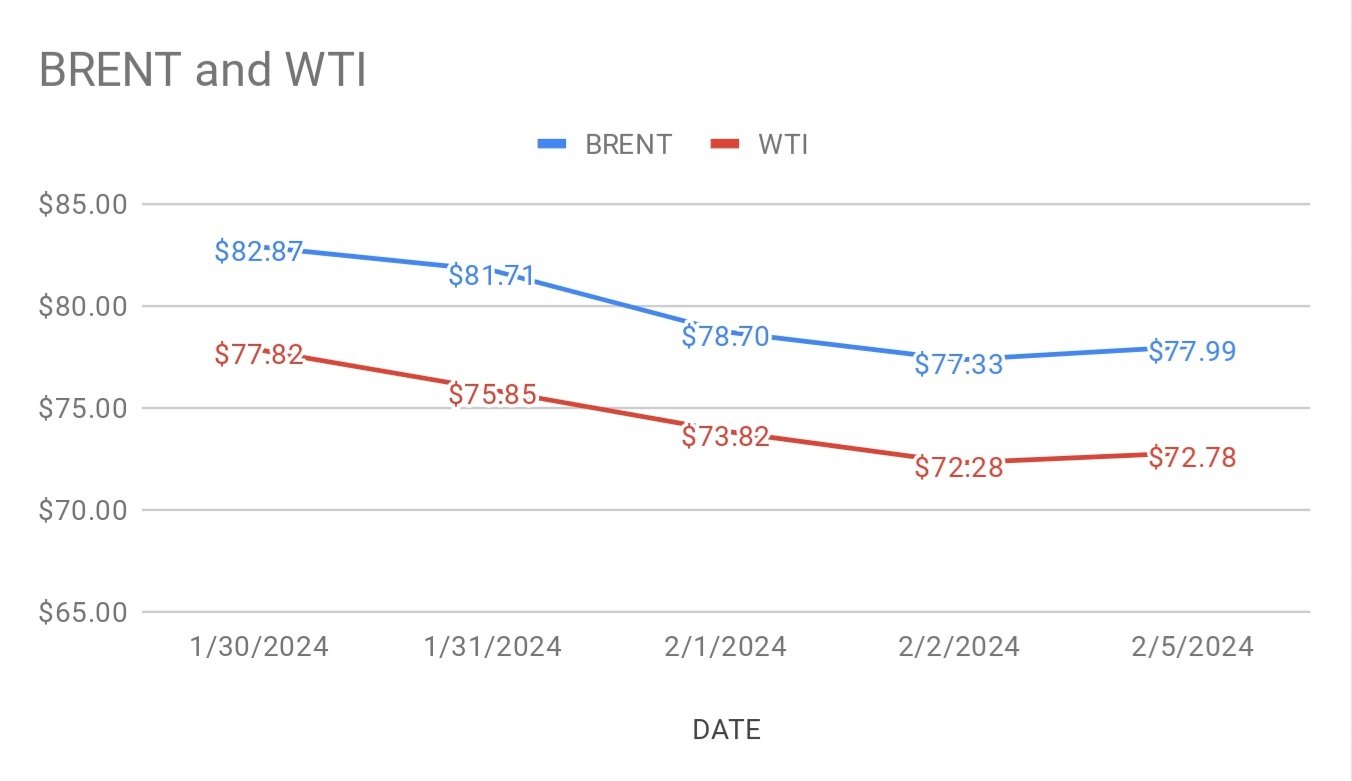

crude brent april futures prices moved up 66 cents or 0.84 percent to $77.99 a barrel while wti futures for march delivery rose 50 cents or 0.68 percent to $72.78 a barrel yesterday. Both the benchmark futures are moving stable today during Asian hours at the time of reporting. Brent premium over wti widened to $5.21 a barrel during the session.

crude benchmark futures curves turned up on Monday after four sessions of sliding down. Market participants keep eye on developments in middle east and Russia ukraine zone. Progress in peace talks between Israel and hamas seems to be elusive and two ukraine drones hit Russian oil refineries are the factors likely to keep prevail geo-political tensions in the markets. U.S continue to campaign against houthis in yemen, whose attacks on vessels confunue to disrupt oil supplies to the world. Strong dollar Limited the oil rally on Monday. Expected rising stocks in U.S also weigh on oil complex.

On technicals side, portfolio managers built up long positions both in brent and wti futures last week whereas shorts left the market during the week ending to 30th Jan. Weekly numbers are awaited. Markets seems to be range bound this week.