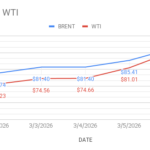

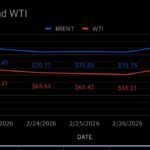

Brent oil futures for Jan delivery moving flat at $77.48 a barrel while WTI Dec futures are steady at $73.03 a barrel on Friday morning during Asian hours at the time of reporting. Both the benchmarks prices tumbled yesterday on bearish weekly numbers. Brent premium over WTI remained unchanged at $4.52 a barrel during yesterday’s session.

The world crude oil benchmark price index curves demonstrated downside momentum yesterday after a slump of around 5 %. Build in U.S crude stocks compounded the prevailing bearish sentiment, Buoyed up by demand worries. Crude stocks piled up by 3.6Mpbd while gasoline stocks and distillates stocks were drawn by 1.5Mbpd and 1.4Mbpd respectively. crude complex is getting pressed by assumption of increasing U.S production that can cater Asian demand . Calender spreads for the first two listed months have flattened into a small contango, Strengthened the anticipation of increasing stocks across.

It is very clear that oil fundamentals are not sending strong signals to investors. ICE and CFTC contracts data is awaited. Rig numbers may spur some volatility in crude market.