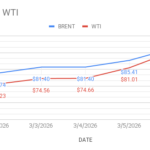

Brent oil Jan futures are trading flat at $80.42 a barrel while WTI oil futures prices for Dec delivery unchanged at $76.04 a barrel on Friday morning. Both the benchmarks closed up yesterday after losing around 7% during the week. Brent premium over WTI widened to $4.27 a barrel during yesterday’s session.

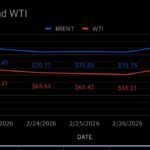

The benchmark futures demonstrated downside momentum since the beginning of the week and set to log in 3rd straight weekly loss. Supply concerns ebbed allowing demand worries to assert themselves for downward pressure. Analysts attributed price slump to high interest rates and gloomy economic outlook. Chinese numbers and supplier’s reiteration of keep tightening spigots did not support price complex. No EIA confirmations this week. Rig numbers are awaited.

ICE and CFTC contracts data is key technical factor to indicate market’s next move. Markets are unlikely to rebound faster since manufacturers in U.S , Europe and China reported worse conditions in October that may trim demand outlook.