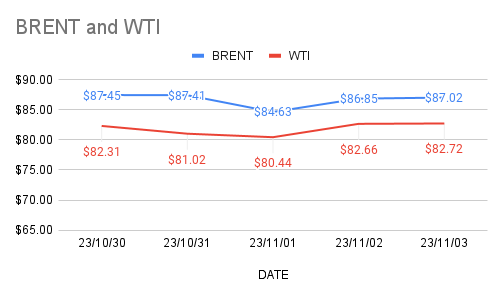

Brent oil futures prices for Jan delivery edged up 16 cents to $87.01 a barrel while WTI oil futures prices for Dec delivery inched up 38 cents to $82.84 a barrel on Friday morning at the time of reporting during Asian hours. Both the benchmarks clocked around 3% yesterday, breaking three-day declining streak. Brent premium over WTI unchanged at $4.19 a barrel during the session.

The world crude oil price indexes turned up, Clawing back some of the losses in 3 sessions early week. Fed decision of keeping interest rate unchanged pushed the risk appetite back to financial markets. BOE also kept rates unchanged for second straight month compounded the positive sentiment that supported bullish sentiment. On the supply side, KSA is expected to reiterate its call for tightening of spigots for 1Mbpd through Dec month.

Investors are closely watching the developments in Middle-east zone. Escalation of political turmoil may lead to tightening supplies that should support oil prices. Crude markets are set to close with weekly losses. Rig numbers are awaited along with ICE and CFTC contracts data.