By Srinivas Chowdary Sunkara // petroabazaar // 14th Oct, 2021.

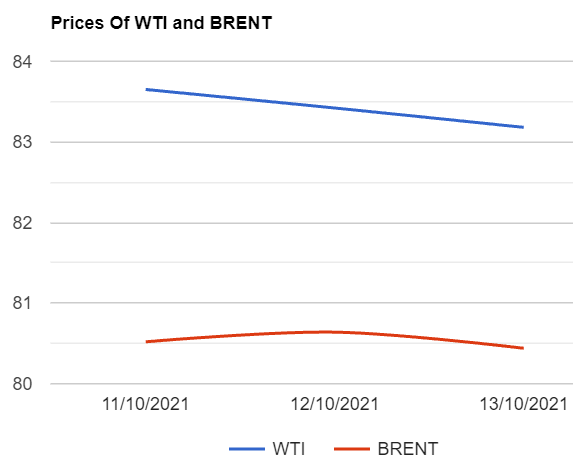

Brent oil futures for Dec delivery slipped 24 cents or 0.29 pct to close at $83.18 a barrel on London based ICE futures Europe exchange. WTI oil Nov futures prices dipped 20 cents or 0.25 % to settle at $80.44 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices closed down 2.5 Yuan to 525.7 Yuan/bbl while MCX front month futures prices closed Rs.26 lower at Rs.6065 a barrel yesterday. Brent premium over WTI unchanged at $2.74 a barrel during yesterday's session.

The world crude oil price index curves moved flat yesterday as the markets are grappled with worries over surging fuel cost for power generation from Shanghai to Delhi. Both the benchmark prices came under pressure after rallying to multi year's high after Chinese data showed falling imports in Sep. Markets are eying on the fact that China , Europe and India are struggling with shortage of coal , Natural gas to generate power. Turing to data side, OPEC monthly report offered something to both bulls and bears. The agency trimmed oil demand growth for 2021 while kept unchanged for 2022 while adjusting non-OPEC supply growth estimated downward. API estimated build in crude stocks by 5.2Mbpd where as product stocks are estimated to be down during the last week. EIA will confirm numbers later today. On the supply side, Putin predicts oil price above $100. U.S said that market should not expect more oil from Iran. Asian markets opened in green today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com