HYDROGEN MARKETS

IEA reported that the Global Hydrogen demand went up 2 pct YOY to 100 Mt in 2024. Oil refining and Industry drove the demand apart from 1 pct contributing from biofuels. Fossilfuels continue to dominate Hydrogen supplies, Consuming 290 bcm of natural gas and 90 Mtce. Low emissions hydrogen grow 10 pct in 2024 that could reach 1 Mt by 2025, but still accounts for under 1 pct of global production.

2030 low-emissions hyderogen projects moving slow stands at 37 mtpa (a dip from 49 mtpa) due to cancellaitons and delayes, mostly in electrolysis. On a positive note, Committed projects suggest output could reach 4.2 Mtpa by 2023, a five fold increase from 2024. Potential production fell for both projects using electrolysis and those using fossil fuels with carbon capture utilisation and storage (CCUS), Although electrolysis projects were responsible for more than 80 pct of the total drop.

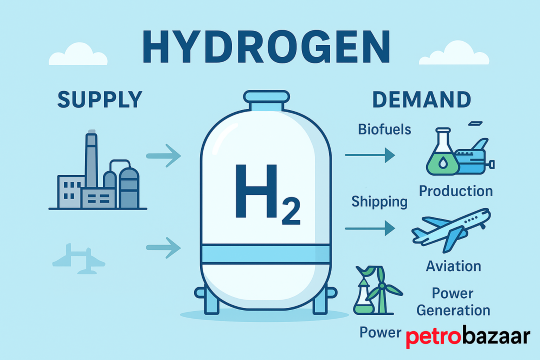

China remains the leader in the electrolyser market, Holding 65 pct of global installed capacity and nearly 60% of global electrolyser manufacturing capacity. China stands much competitive with lower costings to make and install an electrolyser at ($600 – $1200/kW) VS outside of China ($2000 – $2600/KW) despite tariffs and installation costs narrow the gap. Hydrogen offtake agreements reached 1.7mtpa in 2024 (down from 2.4 Mtpa in 2023) with refining, Chemicals , Shipping and aviation driving most investments.

courtesy: BL