By Srinivas Chowdary Sunkara // petrobazaar // 31st May, 2018.

Crude oil prices dropped today

Yesterday, Both the future recovered above 2 pct from a row of losses for last couple of days and currently trading in a bearish mood during Asian markets hours today. Yesterday, prices were supported by a news from a gulf source saying that OPEC and allies continued to adhere with the output cuts till the end and will offset any supply shortfall. Prices were became study after API reported a climb in U.S crude stocks. Upcoming OPEC meet is in focus and physical markets are stabilised and oil prices are largely driven by financial markets. Oil prices performed well this year, rose around 20pct from the beginning of Jan and 50pct since last year.

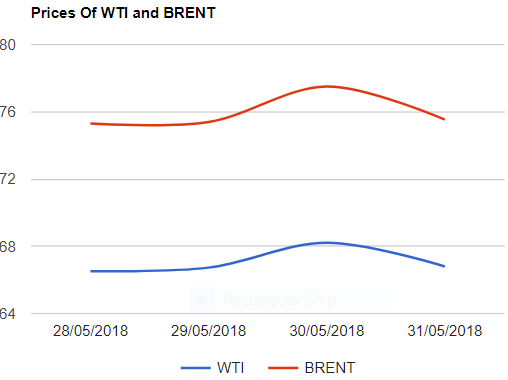

Crude Oil Prices update

Yesterday, U.S crude oil futures, WTI for July settlement rose $1.48 or 2.22% to close at $68.21 a barrel on NYMEX where as Brent futures to be delivered in July jumped by $2.11 or 2.8% at $77.5 per barrel on London based ICE futures Europe exchange. Shanghai futures rose above 2pct while MCX crude futures were up by 1.81% yesterday.

API Report – summary

American Petroleum Institute released weekly report on Wednesday, a day later than usual because of Monday's holiday in U.S. API reported a climb of 1 million barrels of Crude supplies for the week ending May, 25th. The report also showed fall in gasoline stocks and a build in distillates. EIA report is due today and consensus is a stock build.

Comment

Market is continued to focus on OPEC and U.S production numbers. Oil prices are sensitive to related headlines.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com