By Srinivas Chowdary Sunkara // petrobazaar // 27th Sep, 2018.

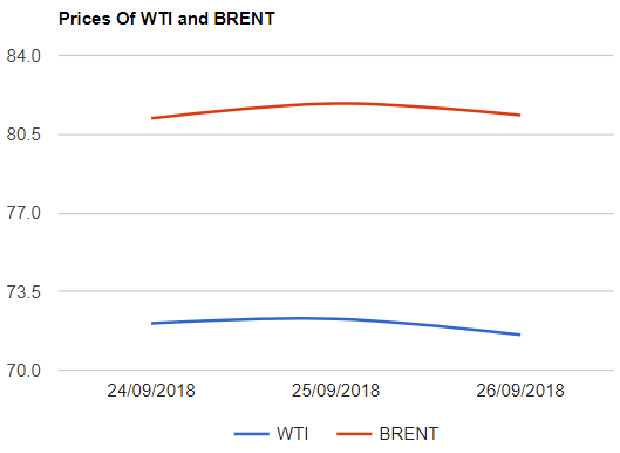

Brent eased to $81.34, down by 53 cents and WTI weakened by 71 cents to $71.57 a barrel yesterday. U.S crude futures were down by around 1 pct on piling up of U.S crude stocks by 1.9 Mb as reported by EIA for the week ended 21st Sep. The seasonal refinery maintenance and increased crude production drived up the U.S stocks. A rise in Cushing and Oklahoma stocks along with the increased weekly production numbers added to the bearish tune in the market. Brent maintained momentum for the consecutive fifth quarterly rise on tightening of supplies. Iran's exports shrank by around 2 Mb as per the shipping records. China and other European countries are exploring alternative ways to currency settlement to dump Iran's discounted oil. India signaled to stop Iran oil import by Nov, 4th. Both the global crude futures are trading up above 1 percent today. Good day.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com