By Srinivas Chowdary Sunkara // petrobazaar // 25th July, 2018.

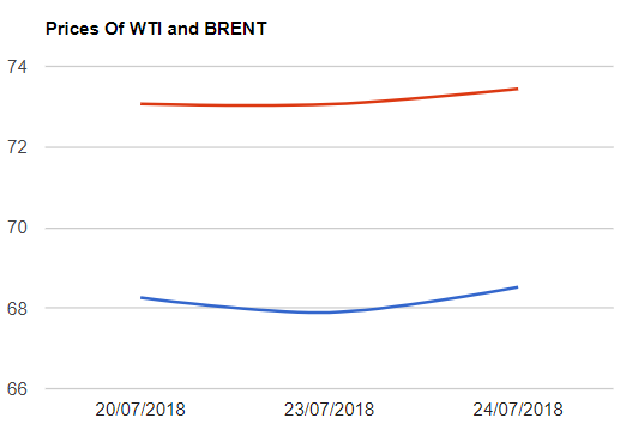

Last night, Sep Brent futures closed up $0.38 at $73.44 and WTI front month futures moved up by $0.63 at $68.52 a barrel. It seems that buyers are coming back after an 8 pct fall from its latest peaks. Market shifted focus from recent trade spats to expected rising oil demand from China's Infrastructure spending. To retaliate economic war from U.S, Iran will threaten by disrupting oil supplies passing through 'The Straight of Hormuz', where proxy war will be stimulated in gulf region will add risk to oil prices.

As per the API numbers for the week ended 20th of July , U.S crude supplies are drawn by 3.16Mb, Gasoline and distillates stocks are fell by 4.87Mb and 1.32 Mb respectively. Another cause of factor to bullish oil prices would be product demand in U.S.. Crude stocks at major U.S storage hubs are expected to fall further. Today morning, Oil prices are opened up in Asian markets. EIA report is awaited to confirm API numbers. Good day.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com