By Srinivas Chowdary Sunkara // petrobazaar // 21-05-2018.

Oil prices creep up

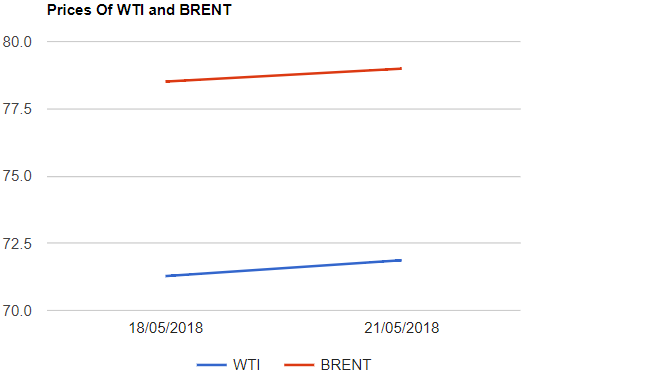

On Friday, Brent closed down with 1.16% and U.S crude lost .29%. Another week of news and reports for bulls ended with straight weekly gains in a row. Last week took Brent to psychological benchmark of $80, which is not a new to the oil market.

Starting the week, In Venezuela, Mr.Nicolas Maduro has won as a president for the second term to another six year term amid severe economic crisis. U.S oil rig numbers were at previous week's levels with no change at nos.844. U.S and China agreeing for 'No trade war' turns to be a positive news for oil. I may be sceptic to guess that the surge in U.S production and possible opening of taps by OPEC in near term would pull oil prices back to $50 – $60 a barrel. why not? Be aware Bulls, who are following OPEC cuts, comments etc.

Crude price update

On Friday, U.S crude futures for June delivery lost 21 cents to close at $71.28 a barrel on NYMEX while Brent futures to be delivered in July were down by 92 cents at $78.51 per barrel on London based ICE futures Europe exchange. Brent booked 1.81% of weekly gains while WTI rose 0.82% during the week.

Comment

Today, Asian markets are opened in a bearish mood with strong dollar dominating metal space with U.S and China agreement of 'No trade war' factor looming around the market backed by bonds yields. Rig numbers are nether supporting not downplayed. Rising U.S production numbers is the concerning factor. Both the futures are slowly creeping along with the volumes.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com