By Srinivas Chowdary Sunkara // petrobazaar // 19th June, 2018.

Crude prices dipped today

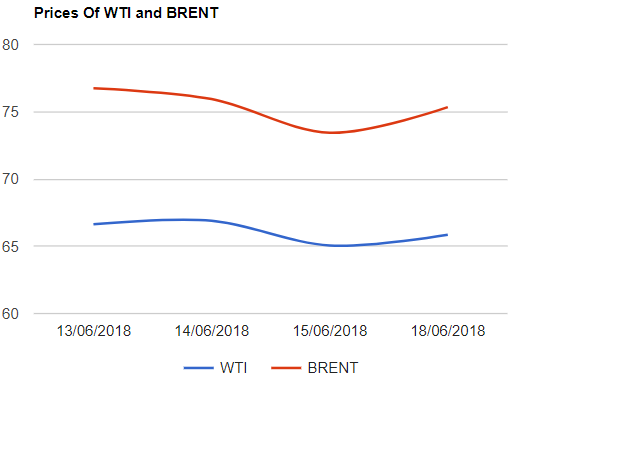

Yesterday, Both the crude futures prices recouped from Friday's sharp drop of above 2 pct and closed high. The escalating trade tariff tensions between U.S and China supported the oil prices. Oil prices turned down today during early Asian trading hours on the expected gradual increase of production by OPEC and non-OPEC countries.

Market is looking at the scheduled producers meet in this week where the supply decision is to be discussed. A group of producers within OPEC are not in agreement to raise production. let us see what will happen?. EIA also indicated a jump in U.S production supported by continued additional rigs into drilling.

Crude price update

Yesterday, U.S crude futures for July delivery gained 79 cents to close at $65.85 a barrel on Nymex where as the Brent futures to be delivered in August closed up with $1.9 at $75.34 per barrel on London based futures Europe exchange. There was no remarkable change in Shanghai futures while MCX futures gained a little. Asian markets opened down along with the financial markets and trading below 0.5 pct from previous closing at the time of reporting.

Comment

Markets seems to be volatile during this week ahead of key OPEC meeting. Any news and statements from producing countries will have significant impact on prices in this week. Bears have space to trade. Tariff tension will continue to drive the oil markets along with financial markets.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com