By Srinivas Chowdary Sunkara // petrobazaar // 7th June, 2018.

Oil price slipped

Yesterday, U.S oil prices were down on bearish weekly stock report. Brent prices moved down on a tussle between OPEC and non-OPEC supplies. EIA reported a surprise build against the analysts expectation of build in stocks across the market. Non-OPEC producers like U.S ramped up production to near 11Mbpd to become world's top producer. Kuwait was in the opinion that supplies should be continued to take the price advantage.

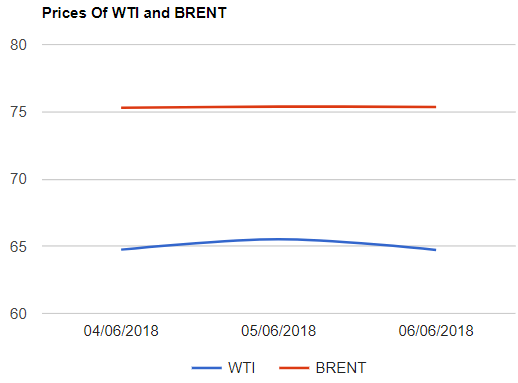

Crude price update

Yesterday, U.S crude July futures dropped by 79 cents to close at $64.73 a barrel on Nymex while Brent futures to be delivered in August inched down by 2 cents at $75.36 per barrel on London based ICE futures Europe exchange. Shanghai futures inched up whereas MCX futures for June delivery lost 1.14 pct. Today Oil prices opened up with positive note during Asian trading hours.

EIA report – summary

In U.S, Crude oil stocks were built up by 2.1Mbpd with 0.5 pct growth from previous week. Gasoline and distillates stocks were on upper side with 4.6 and 2.2 Mbpd respectively. Crude production was boosted to 10.8 Mbpd, nearer to 11Mb. Both imports and exports were on rise. Crude oil inputs in refineries were increased by 0.8% with an improved utilization percentage of 1.5%. Stocks at Midwest and Cushing were down during the week ended.

Comment

Global oil prices followed weekly stats yesterday. U.S weekly stock report was for bears. The volatile movement is expected to continue.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com