By Srinivas Chowdary Sunkara // petrobazaar // 5th June, 2018.

Crude oil prices are likely to be volatile

Both the futures lost nearly 2 pct yesterday and opened up today during Asian trading hours. Concerns on increasing U.S oil production and expected supplies from OPEC continued to weigh on the oil prices. It seems that Market is more worried about the additional supplies either from OPEC or U.S.

EIA monthly report of stating that the U.S crude output reached 10.47 Mbpd in March which is highest on records put pressure on WTI. The unofficial meeting of the OPEC ministers meeting in Kuwait during the week end emphasized for healthy market conditions to attract adequate investments into energy sector, indicating adjustments in supplies. Russians hinted for ramping up 70000 bpd production keep a lid on Brent prices. API report is due to release today followed by EIA stats a day later.

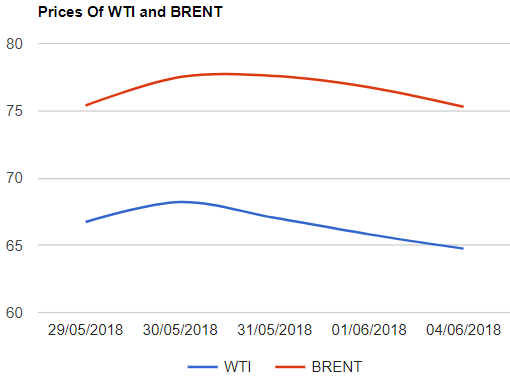

Crude price update

Yesterday, U.S crude futures for July delivery shrank by $1.06 with 1.61 pct of fall to close at $64.75 per barrel on Nymex where as Brent futures to be delivered in August trimmed by $1.46 or 1.9% of fall on London based ICE futures Europe exchange. Shanghai futures and MCX futures also dropped. Today Asian markets are opened up with little change from previous closing price.

Comment

Coming to Fundamentals, Markets are continuing to focus on Supplies and looking for hints. Money managers and hedge funds have dropped long positions and bullish exposure. Volatility is expected till the day of scheduled OPEC meeting on 22nd June.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com