By Srinivas Chowdary Sunkara // petrobazaar // 4th June, 2018.

Oil prices under pressure

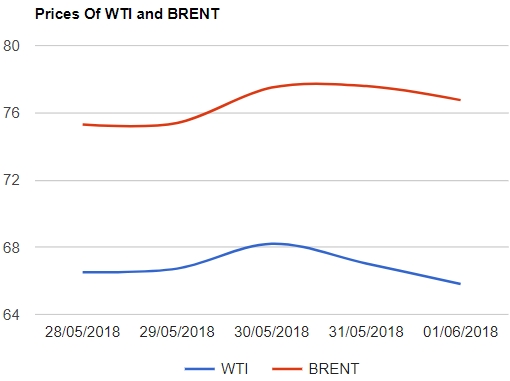

On Friday, U.S oil prices slipped by around 2 pct while Brent futures lost around 1 pct. WTI posted another round of weekly loss of 3 pct for the second week in a row where as Brent gained half a percent. The news of the week was widening of spread between WTI and Brent to $11 after 3 years.

Today Asian markets are opened in bearish mood. U.S imposing Aluminum and steel tariffs worried the market as trade wars lead to weaker economic growth which in turn affect the oil demand. Additional oil rigs by U.S drillers in the week to June 1 along with the increasing U.S production as reported by EIA keep a lid on U.S oil prices. Markets are more concerned with the ongoing talks between OPEC producers to raise production pressuring the Brent prices.

Crude prices update

On Friday, U.S crude futures for July settlement lost $1.23 or 1.83% to close at $65.81 a barrel on Nymex while Brent futures to be delivered in August dropped by 84 cents or 1.08% at $76.75 per barrel on London based ICE futures Europe exchange. Both the futures opened down during Asian hours today.

U.S Rig count – Summary

Drilling activity picked up in U.S during the week ending June 1st. Additional rigs of 2 nos were added, coming to 861Nos. South Texas' Eagle Ford and Oklahoma added 2 nos each while the nation's over all rig count stayed relatively flat. Despite this week's jump, the oil rig count is down 46 percent from its peak of 1,609 in Oct, 2014.

Comment

Many of the hedge funds and money managers are reducing their bullish exposure to oil. Market concerns on supply and strong dollar weigh on oil prices. Bearishness is existed in the market.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com