By Srinivas Chowdary Sunkara // petrobazaar // 31st March, 2021.

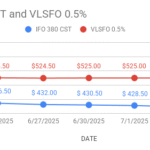

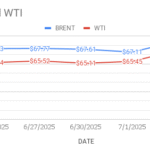

Brent oil futures for June settlement lost 84 cents or 1.29 pct to $64.14 a barrel on London based ICE futures Europe exchange. WTI oil futures to be delivered in May closed $1.01 or 1.64 pct lower at $60.55 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices edged up 10.6 Yuan to 398.6 Yuan/bbl while MCX crude oil current month futures prices settled Rs.32 lower to Rs.4460 a barrel yesterday. Brent premium over WTI widened to $3.59 a barrel during the session.

The world crude oil price indices moved down yesterday as the price gains accumulated during Suez Canal blockage short lived and erased with gradual return to normal traffic. The Greenback rally weighed on oil complex as the rising dollar makes oil costly. Turning to weekly reports, API predicted that U.S crude oil supplies will rose by 3.9 Mb while gasoline stock piles down by 6Mb where as distillate inventories rose by 2.6 Mb. EIA will confirm the numbers later today. Consensus is on build. On the supply side, Traders focus now shifted to producer's council meeting scheduled on Thursday. Analysts expect that the producer's group will roll over production cuts to May and KSA is expected to roll over voluntary cuts through June amid demand fears. Fundamentally speaking, Oil markets are looking shaky with April balances showing crude stocks builds irrespective of what OPEC+ does. Prices strength is expected to delay due to Backwardation, China destocking and weaker demand in Europe and India. Asian markets opened in green today. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com