By Srinivas Chowdary Sunkara // petrobazaar // 30th Dec 2020.

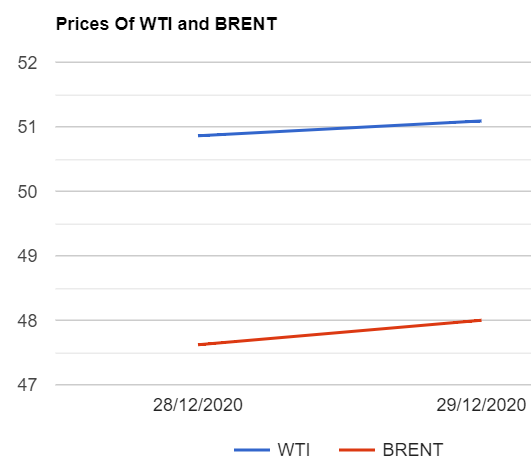

Brent oil futures prices for Feb delivery inched up 23 cents or 0.45% to settle at $51.09 a barrel on London based ICE Futures Europe exchange. WTI oil futures to be delivered in Feb edged up 38 cents or 0.8% to close at $48 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slipped 1.6 Yuan to 305 Yuan/bbl while MCX current month oil futures prices settled down Rs.57 to close at Rs.3526 a barrel yesterday. Brent premium over WTI narrowed down to $3.09 a barrel during the session.

The world crude oil price indices moved up slightly yesterday over prevailing optimism on U.S stimulus package that could spur fuel demand while virus fears capped gains. On the supply side, Fears of prospects of producers group tapering output cuts also looming around the market. Producer's group also known as OPEC+ are scheduled to meet on Jan 4th, 2021. Turning to weekly numbers, API predicted U.S crude oil, Gasoline and Distillates stocks were drawn by 4.785 M, 0.718 M and 1.877M respectively during the last week. EIA will confirm numbers later today. Analysts see dip in crude and build in products stocks. As per CFTC data, Money managers increased their net-length in WTI futures and options. Long-only positions rose by 3333 while short-only positions fell by 2734. Today, Asian markets opened in green.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com