By Srinivas Chowdary Sunkara // petrobazaar // 29th July, 2021.

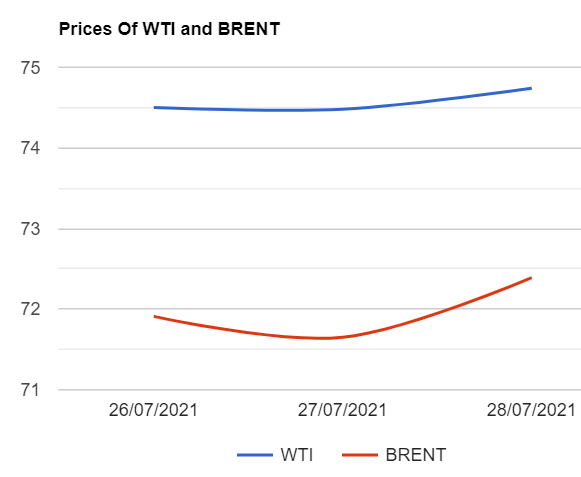

Brent oil futures for Sep delivery advanced 26 cents or 0.35 pct to $74.74 a barrel on London based ICE futures Europe exchange. WTI oil Sep futures climbed 74 cents to close at $72.39 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 4.5 Yuan to 450.5 Yuan/bbl while MCX crude oil front month futures prices settled Rs.59 higher at Rs.5402 a barrel yesterday. Brent traded at a premium of $2.35 a barrel over WTI during the session.

The world crude oil price index curves turned up after a dip in previous session that posted loss in last six days. Traders looked at significant inventory draw in U.S that implied rebound in demand despite of rising Delta virus cases. EIA reported that crude oil stocks dropped 4.1 Mbpd while gasoline and distillates are drawn by 2.3 and 3.1 Mbpd respectively last week. Significant decrease in imports and moderate change in exports contributed to crude stock draws while low refinery rate encouraged decent stock draws in both product stocks in U.S. Production numbers were down while Cushing showed dip in stocks. Markets perceived stock draws as a rebound in demand to push oil prices up. Technically speaking, Portfolio managers, Hedge managers and Fund managers signaled massive liquidation due to rising virus cases that pushed back the anticipated recovery of travel. I think current momentum is a temporary, May not lead to significant rally. Today, Asian markets opened in green, continuing yesterday's gains.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com