By Srinivas Chowdary Sunkara // petrobazaar // 28th May, 2022.

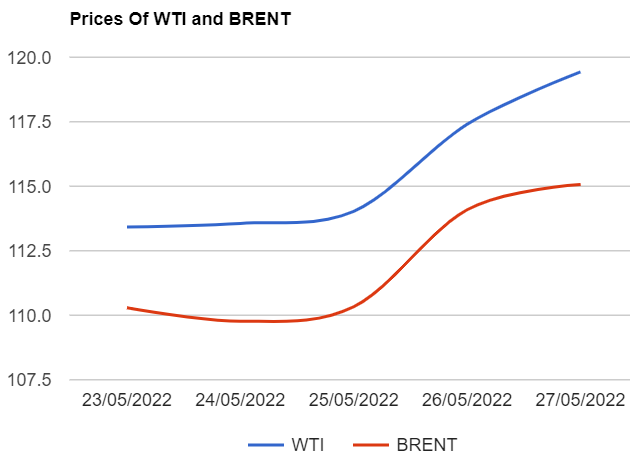

Brent oil July futures prices climbed $2.03 or 1.73 pct to close at $119.43 a barrel on London based ICE futures Europe exchange while U.S crude oil futures prices to be delivered in July rose 98 cents or 0.86 pct to settle at $115.07 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices jumped 15.4Yuan to 730.3 Yuan/bbl where as MCX front month futures prices edged up Rs.34 or 0.38 pct to Rs.8915 a barrel yesterday. Brent traded at a premium of $4.36 a barrel on WTI during the session.

The world crude oil price index curves continued to move up since the beginning of the week amid prevailed positive sentiment on demand come back and weekly bullish numbers. Both the benchmarks posted another weekly gains ahead of U.S memorial day holiday weekend, The start of peak U.S demand season. On the other hand, EU nations negotiate to weigh on option of outright ban on Russian oil. Strong equity markets , Weak dollar and bullish U.S stock numbers extended support to oil complex during this week. Turning to weekly numbers, U.S drillers took out two oil rigs during the last week as per Baker Hughes data. Growing product demand and supply shortages outweighed bleak economic growth and recession fears. Positive sentiment is very likely to be prevailed in the oil market as per analysts.

Good day to all and Happy week end.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com