By Srinivas Chowdary Sunkara // petrobazaar // 26th Nov 2019.

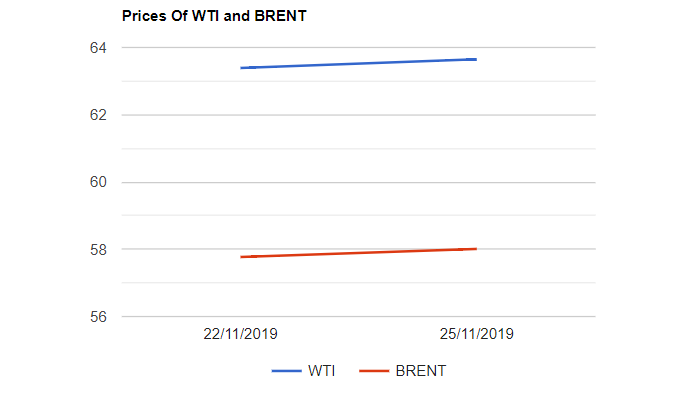

Brent oil futures prices inched up 26 cents to $63.65 and WTI oil futures edged up 24 cents to $58.01 a barrel last night. In Shanghai, Crude oil main contract futures rose by 6.6 Yuan or 1.45% at 463.3 Yuan/barrel while MCX crude oil futures settled Rs.25 down at Rs.4144 yesterday. Brent traded at a premium of $5.64 to WTI.

The world oil price indexes moved steadily on the hopes of two world major economies coming closer to end the trade irritants. Markets are holding on as the path towards de-escalation and cancellation of tariff hikes is nevertheless positive for the market. On the supply side, OPEC members are scheduled to meet at its Vienna headquarters on Dec 5th. OPEC + group is expected to continue to rein in supply cuts till the end of 2020 as per J.P.Morgan. Policy making is one of the key drivers either to stimulate or to falter the energy demand across the world. Despite of all the efforts, 2020 oil demand is directly correlated with the policies of U.S, China and OPEC+ countries. Turning to weekly data, API predictions are due later today.

Today morning, Oil markets opened mix and holding onto gains from previous session during the Asian hours. Any comments on trade deal will spur some volatility in the markets. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com