By Srinivas Chowdary Sunkara // petrobazaar // 25th Sep, 2019.

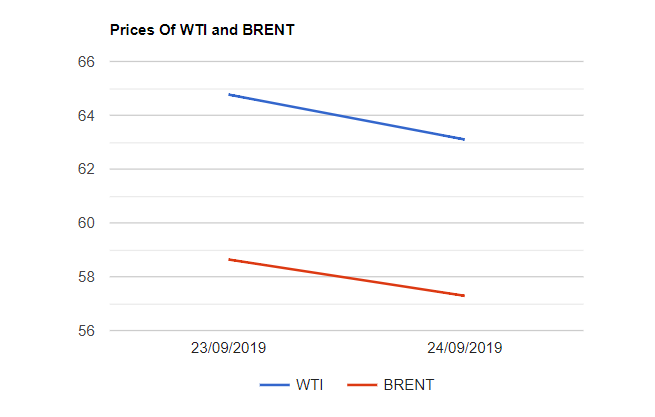

Brent futures lost $1.67 to $63.1 and WTI futures settled $1.35 lower at $57.29 a barrel last night. In Shanghai, Crude oil main contract futures dropped by 4.3 Yuan or 0.92% to 462 Yuan/barrel while MCX crude futures closed Rs.68 down at Rs.4083 yesterday. Brent premium to WTI narrowed to $5.81.

The world crude oil prices plunged after Trump rekindled the fears of U.S-China trade conflict through UN address. The market do not see any constructive tone to resolve the trade disputes. A slump in financial markets, Sluggish economic data from Europe, Falling U.S consumer confidence are the other key factors weighed on oil prices during the yesterday's session. On the supply side, Oil markets are feeling a heat of over supplies despite Saudi's supply disruption due to continued production growth in US and new production from Norway and Brazil. Saudi is arranging oil from neighboring countries like UAE and Kuwait to meet its commitment. Turning to weekly data, API reported a build in US crude inventories while consensus is on draw down. Analysts are in the opinion that the US inventories are very likely to remain low due to halt in energy production by a Tropical storm Imelda and increased exports. EIA will confirm the numbers later today.

Today morning, Oil markets continued to extend losses and the it does not demonstrate any firm trend so far. I expect oil index curve move sideways today. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com