By Srinivas Chowdary Sunkara // petrobazaar // 24th August, 2021.

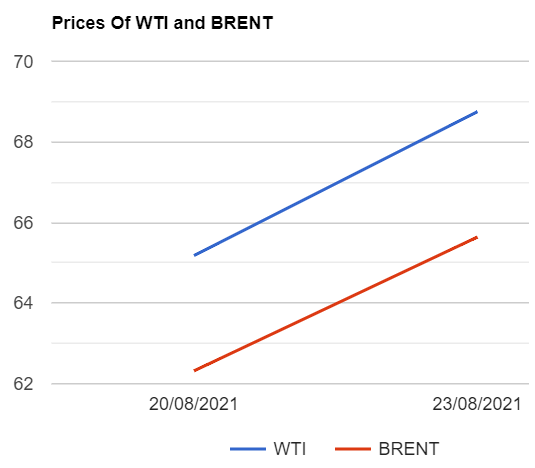

Brent oil futures for Sep delivery jumped $3.57 or 5.48pct to $68.75 a barrel on London based ICE futures Europe exchange. WTI oil futures for Sep delivery gained $3.32 or 5.33% to close at $65.64 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices edged up 0.2Yuan to 405.5Yuan/bbl while MCX crude oil front month futures prices closed Rs.252 high at Rs.4890 a barrel yesterday. Brent premium over WTI widened to $3.11 a barrel during the session.

The world crude oil price index curves turned around to swing up after both the benchmarks snapping the seven-day losing streak that was crude's worst since 2019. Traders felt that last week's sell-off was overdone and started to bet from new lows. Crude basket came under pressure on surging Delta cases in Asia, Europe and especially North America. Weakening dollar also lent support to crude complex. Turning to technicals, Referring to CFTC and ICE weekly data, Hedge funds and other money managers sold petroleum for the seventh time in nine weeks as virus cases in major oil consuming countries dampened hopes for early resumption of long-haul passenger aviation. On the data side, API numbers are awaited later today. Today, Asian markets are opened in green, Continuing yesterday's gains. It does not demonstrate any firm trend so far.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com