By Srinivas Chowdary Sunkara // petrobazaar // 17th May, 2022.

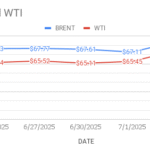

Brent oil futures prices for July delivery rose $2.69 or 2.41 pct to $114.24 a barrel on London based ICE futures Europe exchange while WTI oil futures to be delivered in June traded $3.71 or 3.36 pct to settle at $114.2 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 3.1 Yuan to 700.2 Yuan/bbl while MCX crude oil front month futures prices closed Rs.350 high to Rs.8879 a barrel yesterday. Brent premium over WTI narrowed down to 4 cents during the session.

The world crude oil price index curves moved up after both the benchmarks prices bounced back after fall in early trading hours. Optimism over possible return of demand from China kept flour for oil prices along with the support drawn from EU moving towards reaching a deal on a phase embargo of Russian oil despite concerns about supply in eastern Europe.

On the technials side, Portfolio managers left petroleum futures for the last nine weeks as loss of production from Russia is matched by loss of demand from China and Europe. Bullish long positions outnumbered bearish short positions by ratio of almost 5:1. Global petroleum inventories are low, OPEC+ and shale producers continue to retrain output increases and sanctions threaten to disrupt Russia's oil production and exports are bullish factors prevailed in the market. Crude and fuel prices are high in real numbers, Consumption in China has been reduced by coronavirus lockdowns and all the major economies show signs of slowing economic growth are on the bearish side.

Today, Asian markets opened in bearish mood and it seems that oil markets are caught in between recession and sanctions. API numbers are due later today . Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com