By Srinivas Chowdary Sunkara // petrobazaar // 17th May, 2021.

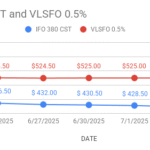

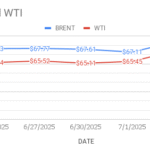

Brent oil futures for July delivery rose $1.66 or 2.48 pct to $68.71 a barrel on London based ICE futures Europe exchange. In U.S, WTI oil June futures jumped $1.55 or 2.43% to close at $65.37 a barrel on NYMEX on Friday. In Shanghai, Crude oil main contract futures prices slumped 10.4 yuan to 414.5 Yuan/bbl while MCX crude oil current month futures prices closed Rs.106 higher at Rs.4786 a barrel on Friday. Brent premium over WTI widened to $3.34 a barrel during the session.

The world crude oil price index curves demonstrated upward momentum on Friday, Reversing previous session sharp losses. Both the benchmarks logged in another weekly gain moderately. Strong equity markets and Weak dollar followed by Federal Reserve signal of no imminent move to tighten monetary policy in U.S that lent support to crude complex. Escalation of worries over surging virus cases in India capped gains. Turning to CFTC and ICE weekly data, Money managers reduced their net-length in both WTI and Brent crude oil futures and options in the week ending May 11th. U.S drillers added 8 nos of oil rigs during the last week as WTI price recovered. U.S crude draws against expected increase, Looks less likely Iran drums , Nigeria loading delays are the other factors that supported oil prices during the week from supply side. Today, Asian markets opened mix, trading in red at the time of reporting. It doesn't demonstrate any firm trend so far.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com