By Srinivas Chowdary Sunkara // petrobazaar // 15th July, 2020.

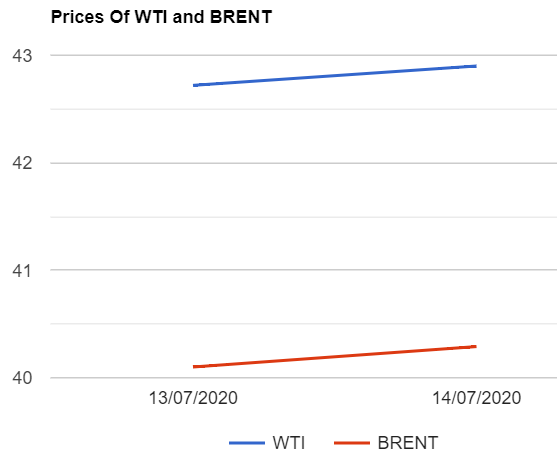

Brent oil futures for Sep delivery rose 18 cents to $42.9 on London based ICE futures Europe exchange and WTI oil futures to be delivered in August closed 19 cents up at $40.29 a barrel on NYMEX last night. In Shanghai, crude oil main contract futures dropped by 3.4 Yuan or 1.1% down where as MCX crude oil current month futures settled Rs.22 down at Rs.3033 a barrel yesterday. Brent traded at a premium of $2.61 over WTI during the session.

The world crude oil prices indices opened flat today during Asian hours. Both the global crude oil benchmarks traded up yesterday after API predicted a big draw in U.S stocks trouncing analysts expectations. Markets were choppy most of the time yesterday searching for clues from the market. Turning to weekly data, API predicted a draw of 8.322 Mb and 3.611M of U.S crude and gasoline stocks while distillates are estimated to pile up 3.03Mb during the last week. EIA will confirm the numbers later today.

Now Bazaar is closely looking at Joint Ministerial Monitoring committee (JMCC) meeting of the OPEC later on Wednesday. Key members of OPEC+ are set to decide whether to continue the cuts of 9.7 Mbpd that end in July as agreed or to ease them to 7.7 Mbpd. The outcome is expected to set the tone for the market. At the outset, There would be two interesting developments to focus today. Whether EIA will confirm API numbers, If so will it outweigh OPEC nod to cut 2 Mbpd. On Technical front, Hedge funds and money managers sold the important petroleum futures and options contracts in the week ending July 7th amid concerns about the faltering economic recovery.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com